Logitech 2007 Annual Report Download - page 88

Download and view the complete annual report

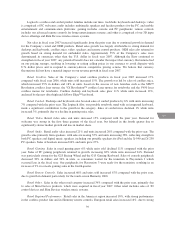

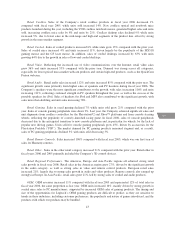

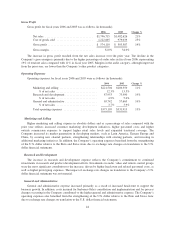

Please find page 88 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Share-Based Compensation Expense

We adopted the fair value recognition provisions of Statement of Financial Accounting Standards No. 123

(revised 2004), “Share-Based Payments” (“SFAS 123R”), effective April 1, 2006, using the modified prospective

transition method. Therefore, results for periods prior to April 1, 2006 have not been restated to include share-

based compensation expense calculated in accordance with SFAS 123R. Share-based compensation expense for

fiscal year 2007 also includes compensation expense, reduced for estimated forfeitures, for awards granted after

April 1, 2006 based on the grant-date fair value estimated using the Black-Scholes-Merton option-pricing

valuation model, recognized on a straight-line basis over the service period of the award. For share-based

compensation awards granted prior to but not yet vested as of April 1, 2006, share-based compensation expense

for fiscal year 2007 was based on the grant-date fair value estimated using the Black-Scholes-Merton option-

pricing valuation model and reduced for estimated forfeitures recognized on a straight-line basis over the service

period for each separately vesting portion of the award. See Note 4—Share-Based Compensation in the Notes to

the Consolidated Financial Statements for further discussion of share-based compensation.

Our estimates of share-based compensation expense require a number of complex and subjective

assumptions including our stock price volatility, employee exercise patterns, future forfeitures, dividend yield,

related tax effects and the selection of an appropriate fair value model. We estimate expected share price

volatility based on historical volatility using daily prices over the term of past options or purchase offerings, as

we consider historical share price volatility as most representative of future stock option volatility. We estimate

expected life based on historical settlement rates, which we believe are most representative of future exercise and

post-vesting termination behaviors. We use historical data to estimate pre-vesting option forfeitures, and we

record share-based compensation expense only for those awards that are expected to vest. The dividend yield

assumption is based on the Company’s history and future expectations of dividend payouts.

The assumptions used in calculating the fair value of share-based compensation expense and related tax

effects represent management’s best estimates, but these estimates involve inherent uncertainties and the

application of management judgment. As a result, if factors change and we use different assumptions, or if we

decide to use a different valuation model, our share-based compensation expense could be materially different in

the future from what we have recorded in the current period, which could materially affect our results of

operations.

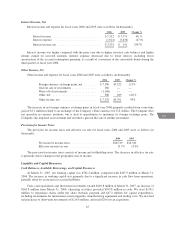

Accounting for Income Taxes

Logitech operates in multiple jurisdictions and its profits are taxed pursuant to the tax laws of these

jurisdictions. The Company’s effective tax rate may be affected by the changes in or interpretations of tax laws in

any given jurisdiction, utilization of net operating loss and tax credit carryforwards, changes in geographical mix

of income and expense, and changes in management’s assessment of matters such as the ability to realize

deferred tax assets. As a result of these considerations, we must estimate income taxes in each of the jurisdictions

in which we operate. This process involves estimating actual current tax exposure together with assessing

temporary differences resulting from different treatment of items for tax and accounting purposes. These

differences result in deferred tax assets and liabilities, which are included in the consolidated balance sheet.

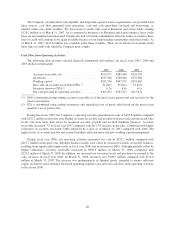

We assess the likelihood that our deferred tax assets will be recovered from future taxable income,

considering all available evidence such as historical levels of income, expectations and risks associated with

estimates of future taxable income and ongoing prudent and feasible tax strategies. We believe it is more likely

than not that such assets will be realized; however, ultimate realization could be negatively impacted by market

conditions and other variables not known or anticipated at this time. In the event we determine that we would not

be able to realize all or part of our deferred tax assets, an adjustment would be charged to earnings in the period

such determination is made. Likewise, if we later determine that it is more likely than not that the deferred tax

assets would be realized, the previously provided valuation allowance would be reversed.

36