Logitech 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

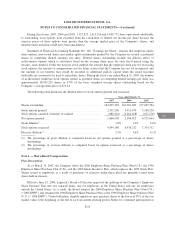

Share-based compensation expense for fiscal 2007 includes compensation expense, reduced for estimated

forfeitures, for share-based compensation awards granted prior to but not yet vested as of April 1, 2006, based on

the grant-date fair value estimated using the Black-Scholes-Merton option-pricing valuation model in accordance

with the original provisions of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-

Based Compensation” (“SFAS 123”). These compensation costs are recognized in accordance with Financial

Accounting Standards Board Interpretation No. 28, “Accounting for Stock Appreciation Rights and Other

Variable Stock Option or Award Plans”, on a straight-line basis over the service period for each separately

vesting portion of the award (multiple-option approach).

Share-based compensation expense for fiscal 2007 also includes compensation expense, reduced for

estimated forfeitures, for awards granted after April 1, 2006 based on the grant-date fair value estimated using

the Black-Scholes-Merton option-pricing valuation model. These compensation costs are recognized on a

straight-line basis over the service period of the award, which is generally the option vesting term of four years

(single-option approach).

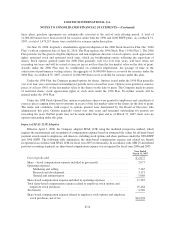

Prior to adopting SFAS 123R, tax benefits resulting from the exercise of stock options were presented as

operating cash flows in the consolidated statement of cash flows. SFAS 123R requires cash flows resulting from

excess tax benefits to be classified as cash flows from financing activities. Excess tax benefits are realized tax

benefits from tax deductions for exercised options in excess of the deferred tax asset attributable to share-based

compensation costs for such options.

The Company will recognize a benefit from share-based compensation in paid-in capital only if an

incremental tax benefit is realized after all other available tax attributes have been utilized. For income tax

footnote disclosure, the Company has elected to offset deferred tax assets against the valuation allowance related

to the net operating loss and tax credit carryforwards from accumulated tax benefits determined under APB 25.

The Company will recognize these tax benefits in paid-in capital in accordance with Footnote 82 of SFAS 123R

when the deduction reduces cash taxes payable. In addition, the Company has elected to account for the indirect

benefits of share-based compensation on the research tax credit through the income statement (continuing

operations) rather than through paid-in capital.

The adoption of SFAS 123R had a material impact on earnings per share and the consolidated financial

statements for fiscal year 2007, and is expected to continue to materially impact the Company’s financial

statements in the foreseeable future. See Note 4 to the consolidated financial statements for further discussion of

share-based compensation.

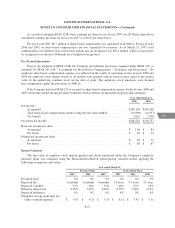

Comprehensive Income

Comprehensive income is defined as the total change in shareholders’ equity during the period other than

from transactions with shareholders. Comprehensive income consists of net income and other comprehensive

income, a component of shareholders’ equity. Other comprehensive income is comprised of foreign currency

translation adjustments from those entities not using the U.S. dollar as their functional currency, unrealized gains

and losses on marketable equity securities, net deferred gains and losses and prior service costs for defined

benefit pension plans, and net deferred gains and losses on hedging activity.

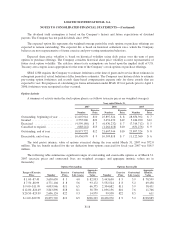

Recent Accounting Pronouncements

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48

defines the threshold for recognizing the benefits of tax return positions in the financial statements as “more-

F-13

CG