Logitech 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

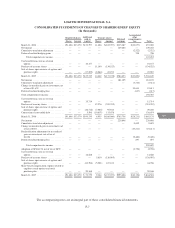

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

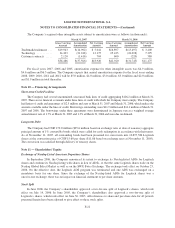

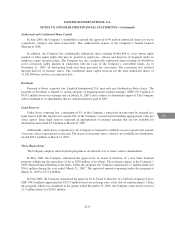

As a result of adopting SFAS 123R, basic earnings per share for fiscal year 2007 was $0.08 per share lower

and diluted earnings per share for fiscal year 2007 was $0.07 per share lower.

For fiscal year 2007, $0.7 million of share based compensation was capitalized to inventory. For fiscal years

2006 and 2005, no share-based compensation cost was capitalized to inventory. As of March 31, 2007, total

compensation cost related to non-vested stock options not yet recognized was $29.2 million, which is expected to

be recognized over the next 36 months on a weighted-average basis.

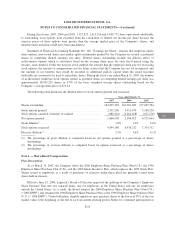

Pro Forma Information

Prior to the adoption of SFAS 123R, the Company provided the disclosures required under SFAS 123, as

amended by SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosures.” No

employee share-based compensation expense was reflected in the results of operations for fiscal years 2006 and

2005 for employee stock option awards as all options were granted with an exercise price equal to the market

value of the underlying common stock on the date of grant. The employee stock purchases were deemed

non-compensatory under the provisions of APB 25.

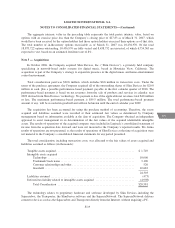

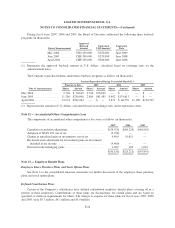

If the Company had used SFAS 123 to account for share-based compensation expense for fiscal years 2006 and

2005, net income and net income per share would have been as follows (in thousands except per-share amounts):

Year ended March 31,

2006 2005

Net income:

As reported .......................................................... $181,105 $149,266

Total share-based compensation expense using the fair value method ............. (19,896) (24,507)

Tax benefit ........................................................... 5,014 5,998

Pro forma net income ...................................................... $166,223 $130,757

Basic net income per share:

As reported .......................................................... $ 1.00 $ .84

Pro forma ............................................................ $ .92 $ .74

Diluted net income per share:

As reported .......................................................... $ .92 $ .77

Pro forma ............................................................ $ .84 $ .67

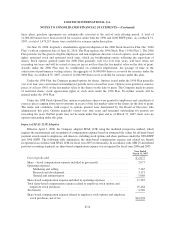

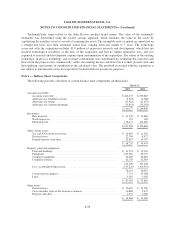

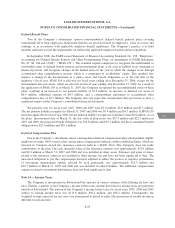

Option Valuation

The fair value of employee stock options granted and shares purchased under the Company’s employee

purchase plans was estimated using the Black-Scholes-Merton option-pricing valuation model applying the

following assumptions and values:

Year ended March 31,

Purchase Plans Stock Option Plans

2007 2006 2005 2007 2006 2005

Dividend yield ................ 0% 0% 0% 0% 0% 0%

Expected life .................. 6months 6 months 6 months 3.9 years 3.7 years 3.5 years

Expected volatility ............. 33% 26% 33% 40% 47% 58%

Risk-free interest rate ........... 4.98% 3.67% 2.06% 4.75% 4.16% 3.15%

Expected forfeitures ............ 0% 0% 0% 8% 0% 0%

Weighted average grant-date fair

value of options granted ....... $ 5.87 $ 4.21 $ 3.13 $ 8.11 $ 7.47 $ 5.11

F-17

CG