Logitech 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

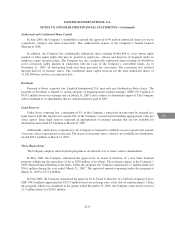

Trademark/trade name relates to the Slim Devices product brand names. The value of the trademark/

tradename was determined using the royalty savings approach, which estimates the value of the assets by

capitalizing the royalties saved as a result of acquiring the assets. The intangible assets acquired are amortized on

a straight-line basis over their estimated useful lives, ranging from one month to 7 years. The technology

associated with the acquisition includes $1.0 million of in-process research and development, which had not

reached technological feasibility at the time of the acquisition and had no further alternative uses, and was

expensed to research and development expense upon consummation of the acquisition. The values of the existing

technology, in-process technology and customer relationships were determined by estimating the expected cash

flows from the projects once commercially viable, discounting the net cash flows back to their present value and

then applying a percentage of completion to the calculated value. The goodwill associated with the acquisition is

not subject to amortization and is not expected to be deductible for income tax purposes.

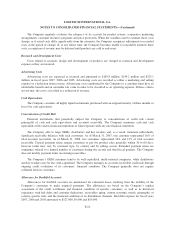

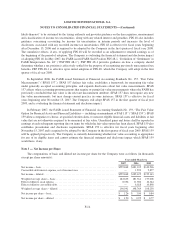

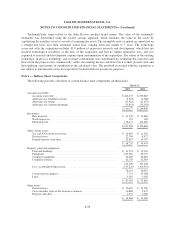

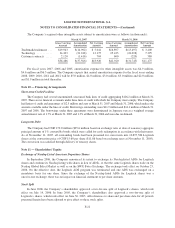

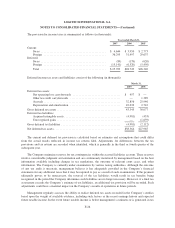

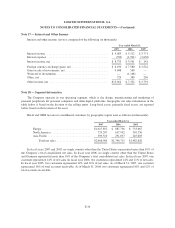

Note 6 — Balance Sheet Components

The following provides a breakout of certain balance sheet components (in thousands):

March 31,

2007 2006

Accounts receivable:

Accounts receivable ................................................. $404,373 $ 356,883

Allowance for doubtful accounts ....................................... (3,322) (2,988)

Allowance for returns ............................................... (15,821) (11,653)

Allowance for customer programs ...................................... (74,853) (52,393)

$ 310,377 $ 289,849

Inventories:

Raw materials ..................................................... $ 41,542 $ 34,860

Work-in-process .................................................... 251 184

Finished goods ..................................................... 176,171 161,820

$ 217,964 $ 196,864

Other current assets:

Tax and VAT refund receivables ....................................... $ 19,695 $ 11,565

Deferred taxes ..................................................... 22,705 8,517

Prepaid expenses and other ........................................... 25,857 14,397

$ 68,257 $ 34,479

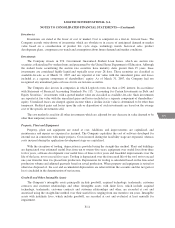

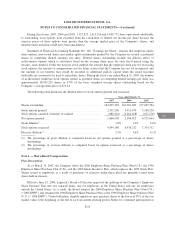

Property, plant and equipment:

Plant and buildings .................................................. $ 31,351 $ 32,181

Equipment ........................................................ 103,016 80,379

Computer equipment ................................................ 34,469 28,829

Computer software .................................................. 42,703 32,019

211,539 173,408

Less: accumulated depreciation ........................................ (135,225) (116,915)

76,314 56,493

Construction-in-progress ............................................. 7,715 15,288

Land ............................................................. 3,025 3,029

$ 87,054 $ 74,810

Other assets:

Deferred taxes ..................................................... $ 20,639 $ 21,560

Cash surrender value of life insurance contracts ........................... 10,888 9,421

Deposits and other .................................................. 2,537 2,082

$ 34,064 $ 33,063

F-20