Logitech 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Seasonality

Our retail product sales are seasonal. Sales are typically highest during the third fiscal quarter (October to

December), due primarily to the increased demand for our products during the year-end holiday buying season,

and to a lesser extent in the fourth fiscal quarter (January to March). Our sales in the first and second quarters can

vary significantly as a result of new product introductions and other factors. Accordingly, year-over-year

comparisons are more indicative of variability in our results of operations than quarter-over-quarter comparisons.

Materials

We purchase some of our products and the key components used in our products from a limited number of

sources. Refer to the discussion in Item 3D Risk Factors – “We purchase key components and products from a

limited number of sources, and our business and operating results could be harmed if supply were delayed or

constrained or if there were shortages of required components.”

C. Organizational Structure

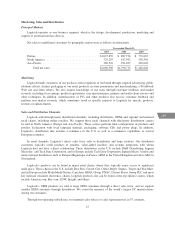

The following lists the Company’s significant subsidiaries:

Name

Country of

Incorporation

Ownership

Interest

Logitech Inc. ......................................... U.S. 100%

Logitech Asia Pacific Limited ........................... Hong Kong 100%

Logitech Technology (Suzhou) Co. Ltd. ................... China 100%

Logitech Europe S.A. .................................. Switzerland 100%

D. Property, plant and equipment

Logitech’s Europe headquarters are in Romanel-sur-Morges, Switzerland, in a Company-owned facility

comprising 33,300 square feet, occupied by research and development, product marketing, technical support,

administration and certain Logitech group activities including finance. We lease two additional facilities of 8,700

and 8,400 square feet in Morges, Switzerland. These leases expire in June 2007 and July 2007. Sales and

marketing, including sales management, are located in these facilities. We have signed a lease on a new facility

in Morges, comprising approximately 51,000 square feet, which we began occupying in April 2007. This facility

is occupied by sales and marketing management, technical support, administration and certain Logitech group

activities, including finance, legal and human resources. The lease began in January 2007 and will continue for

10 years, with the option for Logitech to terminate the lease after 5 years.

In North America, our headquarters in Fremont, California consist of four leased buildings comprising

approximately 172,000 square feet. These facilities are occupied by Logitech’s Americas headquarters, including

research and development, product marketing, sales management, technical support and administration. The

Fremont lease expires in March 2013. The audio business unit is located in 36,000 square feet of leased office

space in Vancouver, Washington. This lease expires in April 2009. We also lease approximately 18,000 square

feet in Mountain View, California, occupied by our streaming media group, on a lease which expires in May

2011. In addition, we sublease approximately 20,000 square feet in Mississauga, Canada for our remote controls

group, on a lease which expires in September 2009.

Our 3Dconnexion subsidiary has subleased a 5,500 square foot office in San Jose, California through

December 2007. In Seefeld, Germany, 3Dconnexion has leased 15,000 square feet through the year 2010 for its

European headquarters, research and development, and manufacturing.

Worldwide operations and engineering occupy a Logitech-owned 112,000 square foot facility in Hsinchu,

Taiwan, which includes mechanical engineering, new product launches, process engineering, commodities

management, logistics, quality assurance, and administration. Personnel in Hsinchu manage distribution of

31

CG