Logitech 2007 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

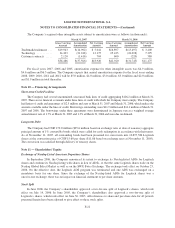

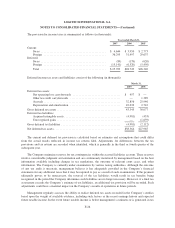

The dividend yield assumption is based on the Company’s history and future expectations of dividend

payouts. The Company has not paid dividends since 1996.

The expected option life represents the weighted-average period the stock options or purchase offerings are

expected to remain outstanding. The expected life is based on historical settlement rates, which the Company

believes are most representative of future exercise and post-vesting termination behaviors.

Expected share price volatility is based on historical volatility using daily prices over the term of past

options or purchase offerings. The Company considers historical share price volatility as most representative of

future stock option volatility. The risk-free interest rate assumptions are based upon the implied yield of U.S.

Treasury zero-coupon issues appropriate for the term of the Company’s stock options or purchase offerings.

SFAS 123R requires the Company to estimate forfeitures at the time of grant and to revise those estimates in

subsequent periods if actual forfeitures differ from those estimates. The Company uses historical data to estimate

pre-vesting option forfeitures and records share-based compensation expense only for those awards that are

expected to vest. For purposes of calculating pro forma information under SFAS 123 for periods prior to April 1,

2006, forfeitures were recognized as they occurred.

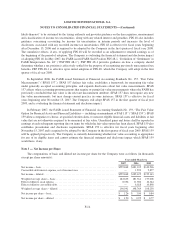

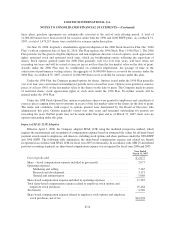

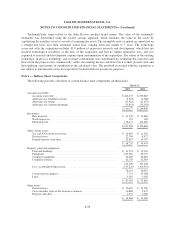

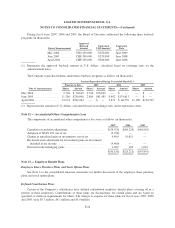

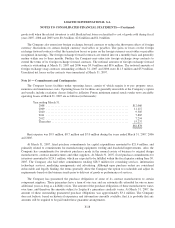

Option Activity

A summary of activity under the stock option plans is as follows (exercise prices are weighted averages):

Year ended March 31,

2007 2006 2005

Number

Exercise

Price Number

Exercise

Price Number

Exercise

Price

Outstanding, beginning of year ......... 21,607,944 $10 25,897,324 $ 8 28,656,392 $ 7

Granted ............................ 2,555,200 $22 3,451,470 $19 5,186,920 $12

Exercised .......................... (4,599,180) $ 7 (6,476,232) $ 7 (7,314,712) $ 5

Cancelled or expired .................. (688,242) $13 (1,264,618) $10 (631,276) $ 9

Outstanding, end of year ............... 18,875,722 $12 21,607,944 $10 25,897,324 $ 8

Exercisable, end of year ............... 10,436,970 $ 9 10,509,818 $ 7 11,122,360 $ 6

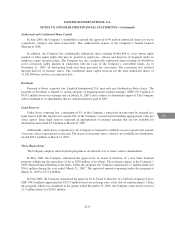

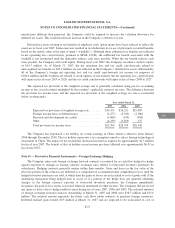

The total pretax intrinsic value of options exercised during the year ended March 31, 2007 was $72.0

million. The tax benefit realized for the tax deduction from options exercised for fiscal year 2007 was $16.5

million.

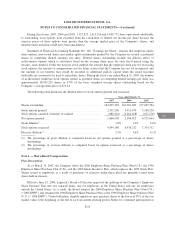

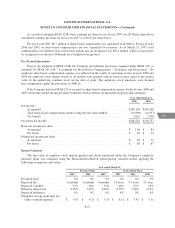

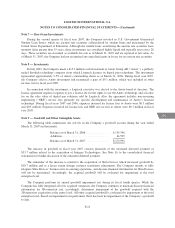

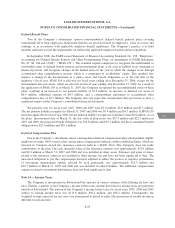

The following table summarizes significant ranges of outstanding and exercisable options as of March 31,

2007 (exercise prices and contractual lives are weighted averages, and aggregate intrinsic values are in

thousands):

Options Outstanding Options Exercisable

Range of Exercise

Price Number

Exercise

Price

Contractual

Life (years)

Aggregate

Intrinsic

Value Number

Exercise

Price

Contractual

Life (years)

Aggregate

Intrinsic

Value

$ 1.00 -$7.49 3,650,650 $ 5 4.0 $ 82,953 3,443,650 $ 5 3.9 $ 78,599

$ 7.50 -$8.99 4,771,104 $ 8 5.6 93,172 3,552,524 $ 8 5.2 69,458

$ 9.00 -$11.99 4,003,946 $11 6.5 66,375 2,304,682 $11 5.9 38,451

$ 12.00 -$20.49 3,843,898 $18 8.1 38,750 1,036,156 $16 7.6 11,766

$ 20.50 -$29.99 2,606,124 $22 9.3 14,979 99,958 $22 8.5 611

$ 1.00 -$29.99 18,875,722 $12 6.5 $296,229 10,436,970 $ 9 5.2 $198,885

F-18