Logitech 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

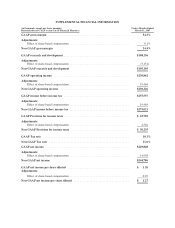

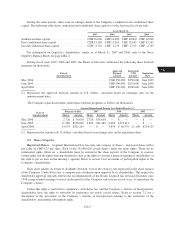

GROSS MARGIN

40%

30%

20%

0%

30.9%

31.7%

33.4% 33.1%

32.2%

34.0%

32.0%

34.3%

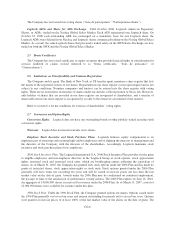

NET CASH POSITION

400

350

300

250

200

150

100

50

0

-50

MILLIONS $

40

-46

33

144

184

231

399

FY 00 01 02 03 04 05 06 07 FY 00 01 02 03 04 05 06 07

77

of the products they replaced. The focus of our product

development teams on optimizing product cost paid off

handsomely in a number of categories, particularly in

cordless mice and desktops, PC speakers and PC gaming.

Another contributor to our gross margin improvement

was the cost-effective performance of our global supply

chain, with our total supply chain costs increasing by

only 7 percent year over year, less than half as fast as the

15 percent increase in sales.

While higher ASPs clearly helped us generate sales growth,

they played a minor role in our gross margin improvement.

Due to consistent innovation across all price points, the

distribution of our sales-per-price-band was relatively

stable once again in FY 2007. This resulted primarily from

generating the majority of our sales at price points below

$100, where consumer price elasticity is minimal. Our

business model has allowed us to avoid the precipitous

price declines seen in the mobile phone or PC industries.

In contrast, we’ve even been able to increase our price

points for our high-end mice as each generation offered

even more value to the consumer.

Record Operating Margin* Coupled with Strong

Investments for the Future

The strong sales growth coupled with our record-breaking

gross margin led to a 100 basis point improvement in

our operating margin to 12.1 percent—a new company

record. Our operating income grew 26 percent year

over year to $250 million. At the same time, we continued

to fund long-term R&D projects to develop the break-

through innovation essential to generate growth in sales

and profi t. We also invested heavily in improving the

scalability of our operations. In July 2006 we completed

our most extensive company-wide project ever, the

implementation of our new enterprise resource planning

(ERP) system, Oracle 11i. More than 500 people contributed

to the success of this critically important project.

38 Percent Growth in EPS*

The growth in operating profi t was coupled with solid

fi nancial income. We generated over $9 million in other

income from the sale of our investment in Anoto. Our

tax rate in FY 2007 declined by 300 basis points to 11

percent. These factors contributed to the very strong net

income growth of 35 percent to $245 million. Our EPS

grew by 38 percent year over year to $1.27, enhanced by

buying back 5.6 million of our shares for $138 million

during FY 2007.

Working Capital: Big Improvement

We brought a renewed focus in FY 2007 to optimizing

the conversion of income into cash fl ow. The result was a

9 day improvement in our cash conversion cycle. The cash

cycle improvement was made possible by a reduction of

4 days in our days sales outstanding and an increase of 5

days in days payables outstanding. Better working capital

effi ciency was a key factor in our generation of an all time

high of $306 million in cash fl ow from operations, which

was twice as high as that of the prior year.

Outlook: Growth Ahead

We enter Fiscal Year 2008 well positioned for sustained

growth and profi tability, with an innovative and appealing

product roadmap targeted at substantial growth categories,

a broad and resilient product portfolio, and a strong and

experienced management team focused on delivering

against our targets.

We believe that our investments in innovation coupled

with strong secular growth trends are a promising recipe

for continued double-digit growth. For Fiscal Year 2008

we target year-over-year growth of 15 percent in both

sales and operating income. As pleased as we are with

our results in Fiscal Year 2007, we’re excited about the

opportunity to continue on our long-term double-digit

growth path.

* Non-GAAP measure excluding the cost of share-based compensation