Logitech 2007 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

jurisdictions different than projected, the Company could be required to increase the valuation allowance for

deferred tax assets. This would result in an increase in the Company’s effective tax rate.

Deferred tax assets relating to tax benefits of employee stock option grants have been reduced to reflect the

exercises in fiscal year 2007. Some exercises resulted in tax deductions in excess of previously recorded benefits

based on the option value at the time of grant (“windfalls”). Although these additional tax benefits are reflected

in net operating loss carryforwards, pursuant to SFAS 123(R), the additional tax benefit associated with the

windfall is not recognized until the deduction reduces cash taxes payable. When the tax benefit reduces cash

taxes payable, the Company will credit equity. During fiscal year 2007, the Company recorded a credit to equity

of $14.7 million. As of March 31, 2007, the net operating loss and tax credit carryforwards related to

unrecognized tax benefits of $47.2 million are not reflected in the Company’s deferred tax assets. Substantially

all of the Company’s foreign net operating loss and tax credit carryforwards for income tax purposes of

$100.6 million and $8.3 million are related to stock options. If not utilized, the net operating loss carryforwards

will expire in fiscal years 2019 to 2026, and the tax credit carryforwards will expire in fiscal years 2008 to 2027.

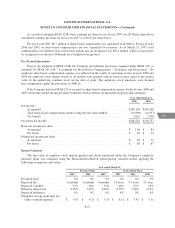

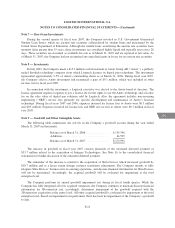

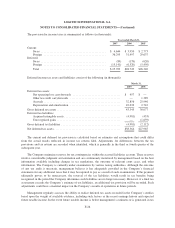

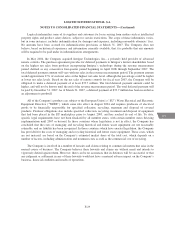

The expected tax provision at the weighted average rate is generally calculated using pre-tax accounting

income or loss in each country multiplied by that country’s applicable statutory tax rates. The difference between

the provision for income taxes and the expected tax provision at the weighted average tax rate is reconciled

below (in thousands):

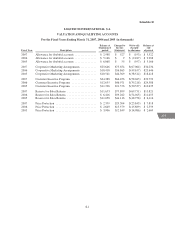

Year ended March 31,

2007 2006 2005

Expected tax provision at weighted average rate ........ $34,393 $36,251 $29,087

Foreign income taxes at different rates ............... (2,477) (5,543) (2,580)

Research and development tax credits ................ (1,868) (140) (304)

Other .......................................... (4,339) (1,819) 137

Total provision for income taxes .................... $25,709 $28,749 $26,340

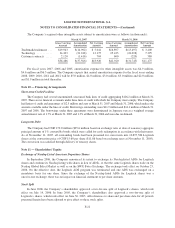

The Company has negotiated a tax holiday on certain earnings in China which is effective from January

2006 through December 2010. The tax holiday represents a tax exemption aimed to attract foreign technological

investment in China. The impact of the tax holiday decreased income tax expense by approximately $2.5 million

for fiscal year 2007. The benefit of the tax holiday on net income per share (diluted) was approximately $0.01 in

fiscal year 2007.

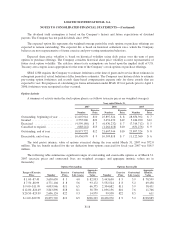

Note 15 — Derivative Financial Instruments – Foreign Exchange Hedging

The Company enters into foreign exchange forward contracts (accounted for as cash flow hedges) to hedge

against exposure to changes in foreign currency exchange rates related to forecasted inventory purchases by

subsidiaries. Hedging contracts generally mature within three months. Gains and losses in the fair value of the

effective portion of the contracts are deferred as a component of accumulated other comprehensive loss until the

hedged inventory purchases are sold, at which time the gains or losses are reclassified to cost of goods sold. If the

underlying transaction being hedged fails to occur or if a portion of the hedge does not generate offsetting

changes in the foreign currency exposure of forecasted inventory purchases, the Company immediately

recognizes the gain or loss on the associated financial instrument in other income. The Company did not record

any gains or losses due to hedge ineffectiveness during fiscal years 2007, 2006 and 2005. The notional amounts

of foreign exchange forward contracts outstanding at March 31, 2007 and 2006 were $38.5 million and $13.6

million. The notional amount represents the future cash flows under contracts to purchase foreign currencies.

Deferred realized gains totaled $0.3 million at March 31, 2007 and are expected to be reclassified to cost of

F-27

CG