Logitech 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

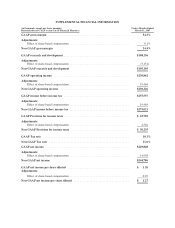

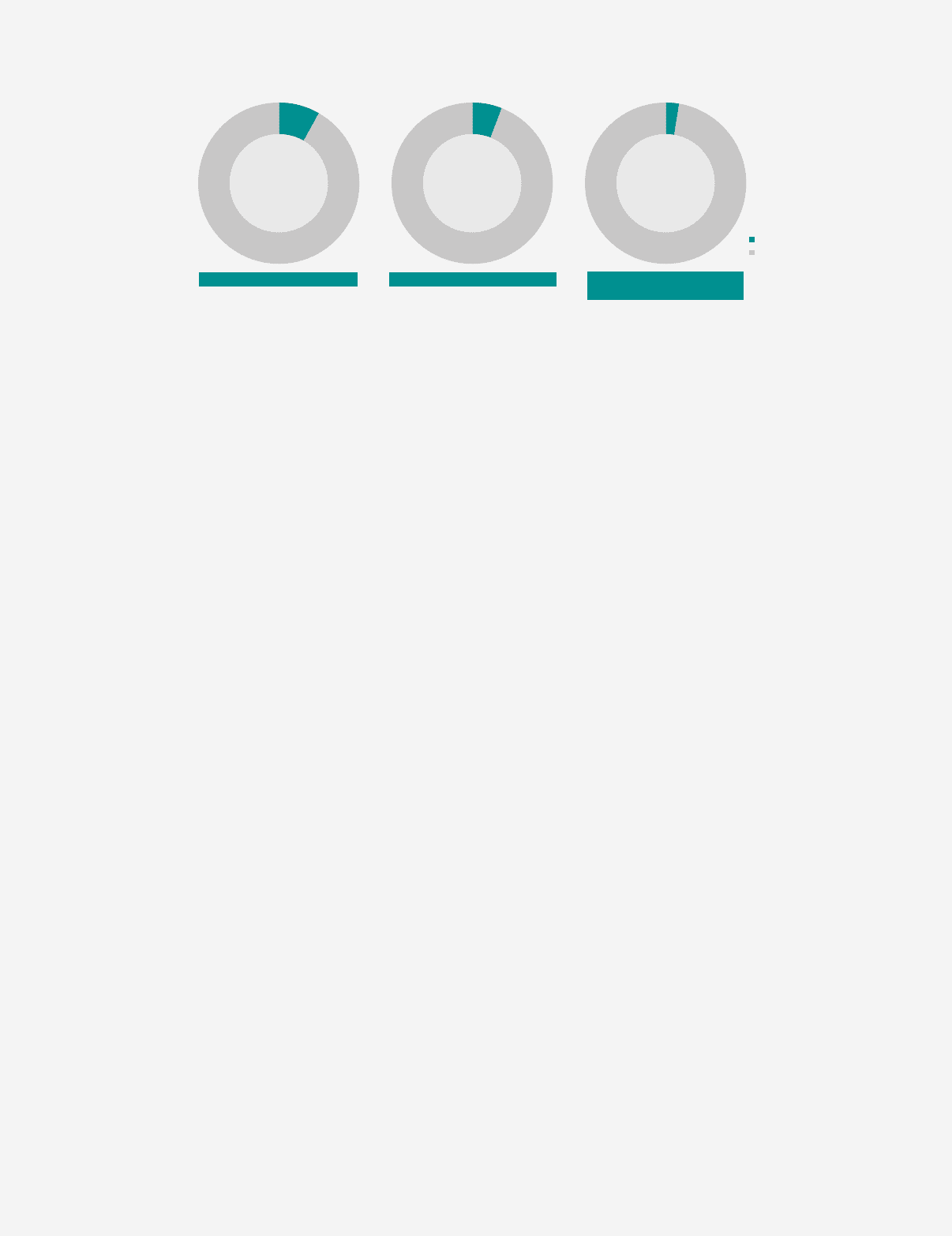

U.S. HOUSEHOLDS WITH PVR U.S. HOUSEHOLDS WITH

DIGITAL CABLE OR SATELLITE

U.S. HOUSEHOLDS WITH HDTV

HARMONY GROWTH POTENTIAL IN U.S.

With Harmony

Without Harmony

Source: Logitech estimates based on available market data

our capabilities in this nascent market, in October 2006

we acquired the Mountain View, California-based Slim

Devices for $20 million plus a possible performance-based

payment tied to reaching future revenue targets. Slim

Devices has developed a solution that enables people

to enjoy high-quality digital music, in multiple rooms of

the home, regardless of whether the music is streaming

directly from the Internet, or from a PC, Mac®, or storage

device on the network. We’re excited about the potential

for this emerging category and believe it can be a strong

growth driver for us in the years to come.

Harmony: Ready for the Mass Market

Fiscal Year 2007 was an excellent year for our Harmony®

remotes, with sales up by 60 percent to $92 million. Our

unique database-based solution for universal remote

controls has placed us in the market-leading position

for the overall remote control category in the U.S. with

a market share exceeding 30 percent. Our key strategic

goal for our advanced universal remotes in FY 2007 was

to broaden their appeal to the “early majority” of mass-

market consumers. We invested signifi cantly to simplify

the Harmony experience with new software and Internet

applications. In addition to broadening the addressable

user-base through a more satisfying setup experience,

we also expanded our hardware portfolio with the

Harmony 1000. This top-of-the-line remote offers a color

touch screen to control infrared devices as well as devices

with Z-Wave™ technology such as light switches or high-

voltage alternating current (HVAC) systems.

Even with our initial success, we estimate the penetration

of Harmony remotes in the 59 million U.S. households with

digital cable or satellite is still less than 2 percent, an

indication of what we believe is a vast growth opportunity.

Beyond the U.S. market, we continue to roll out the Harmony

remotes in Europe and Asia Pacifi c.

Gaming: Strong Growth in PC Category—Ready to Ride

the Playstation3 Wave

Fiscal Year 2007 was a transitional period for our gaming

business, with sales up by 6 percent year over year to

$146 million. The transition was related to our peripherals

for gaming consoles, where sales declined by 38 percent.

This decline was due primarily to the transition from the

Playstation®2 to the Playstation®3, which was launched

during the latter part of our fi scal year. While we were

ready with offerings for the Playstation3 at launch, our

opportunity for strong growth in the category is largely

dependent on the size of the installed base of game

consoles. We expect that the Playstation3 installed base

will be substantial by Christmas 2007 and that sales of our

console gaming controllers should benefi t accordingly.

Fiscal Year 2007 was a great year for our PC gaming

business, with sales up 63 percent year over year. This

strong performance was driven primarily by the success

of products like our G15 Gaming Keyboard and our G25

Racing Wheel. We also added signifi cant innovation to

the gaming controller category with our Chillstream™

technology, which keeps gamers’ hands dry with a

proprietary built-in cooling fan.

Innovation is the Key: The Making of a Mouse

Our results in FY 2007 are the latest demonstration of

our ability to consistently deliver innovative products at

attractive, stable price points that allow us to reliably

grow our profitability. Our track record of productive

innovation has taught us that competitive breakthroughs

don’t just happen. They require a robust pipeline of new