Logitech 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

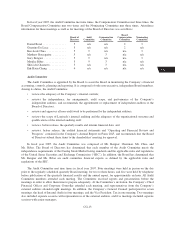

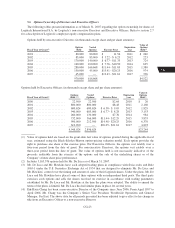

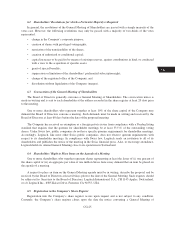

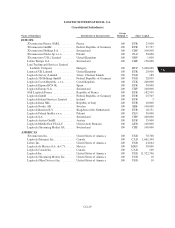

5.6 Option Ownership of Directors and Executive Officers

The following tables present information as of March 31, 2007 regarding the option ownership for shares of

Logitech International S.A. by Logitech’s non-executive Directors and Executive Officers. Refer to section 2.7

for a description of Logitech’s employee equity compensation plans.

Options held by non-executive Directors (in thousands except share and per share amounts):

Fiscal Year of Grant(4)

Options

Held

Vested

Options Exercise Price

Expiration

year

Value of

Options

Held(1)

2001 ......................... 80,000 80,000 $ 11.54 2011 $ 260

2002 ......................... 85,000 85,000 $ 5.22 - $ 6.25 2012 223

2003 ......................... 170,000 140,000 $ 6.77 - $11.35 2013 724

2004 ......................... 160,000 100,000 $ 7.76 - $10.50 2014 625

2005 ......................... 280,000 166,668 $11.44 - $11.85 2015 1,380

2006 ......................... 150,000 45,000 $15.41 - $20.25 2016 974

2007 ......................... 45,000 — $19.43 - $21.61 2017 336

970,000 616,668 $4,522

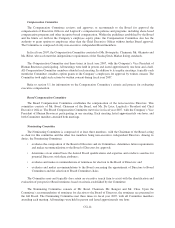

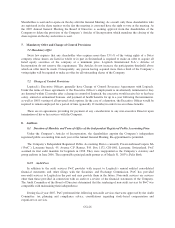

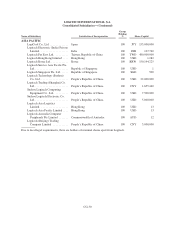

Options held by Executive Officers (in thousands except share and per share amounts):

Fiscal Year of Grant(4)

Options

Held(2)(3)

Vested

Options Exercise Price

Expiration

year

Value of

Options

Held(1)

2000 ..................... 22,500 22,500 $2.64 2010 $ 20

2001 ..................... 800,000 800,000 $8.48 2011 2,160

2002 ..................... 680,624 680,624 $ 6.58 - $ 9.05 2012 1,829

2003 ..................... 940,000 685,000 $ 6.77 - $ 8.28 2013 3,153

2004 ..................... 260,000 130,000 $7.76 2014 984

2005 ..................... 732,000 366,000 $11.44 - $12.29 2015 3,835

2006 ..................... 900,000 212,500 $14.98 - $20.25 2016 6,370

2007 ..................... 612,900 — $20.05 - $21.61 2017 4,893

4,948,024 2,896,624 $23,244

(1) Value of options held are based on the grant-date fair value of options granted during the applicable fiscal

year, estimated using the Black-Scholes-Merton option-pricing valuation model. Each option provides the

right to purchase one share at the exercise price. For Executive Officers, the options vest ratably over a

four-year period from the date of grant. For non-executive Directors, the options vest ratably over a

three-year period from the date of grant. The value of options held is not necessarily indicative of the

proceeds realizable from the exercise of the options and the sale of the underlying shares or of the

Company’s future share price performance.

(2) Includes 3,163,576 options held by Mr. De Luca as of March 31, 2007.

(3) Mr. De Luca and Mr. Hawkins have each adopted trading plans in compliance with Swiss rules and Rule

10b5-1 under the U.S. Securities Exchange Act of 1934 that are designed to eliminate Mr. De Luca and

Mr. Hawkins’ control over the timing and amount of sales of their Logitech shares. Under the plans, Mr. De

Luca and Mr. Hawkins have placed some of their options with an independent third party. The third party

exercises such options and sells the shares received on exercise in accordance with trading parameters

established by Mr. De Luca and Mr. Hawkins at the time the plans were adopted. The ability to amend the

terms of the plans is limited. Mr. De Luca has had similar plans in place for several years.

(4) Erh-Hsun Chang has been a non-executive Director of the Company since June 2006. From April 1997 to

April 2006, Mr. Chang was the Company’s Senior Vice President, Worldwide Operations and General

Manager, Far East. The above data for all periods presented has been adjusted to give effect to his change in

title from an Executive Officer to a non-executive Director.

CG-23

20-F

LISA