Logitech 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

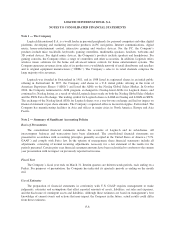

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

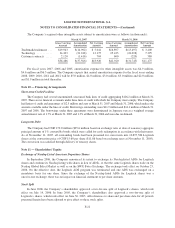

these plans, purchase agreements are automatically executed at the end of each offering period. A total of

12,000,000 shares have been reserved for issuance under both the 1996 and 2006 ESPP plans. As of March 31,

2007, a total of 1,479,217 shares were available for issuance under these plans.

On June 16, 2006, Logitech’s shareholders approved adoption of the 2006 Stock Incentive Plan (the “2006

Plan”) with an expiration date of June 16, 2016. The Plan replaces the 1996 Stock Plan (“1996 Plan”). The 2006

Plan provides for the grant to eligible employees and non-employee directors of stock options, stock appreciation

rights, restricted stock and restricted stock units, which are bookkeeping entries reflecting the equivalent of

shares. Stock options granted under the 2006 Plan generally will vest over four years, will have terms not

exceeding ten years and will be issued at exercise prices not less than the fair market value on the date of grant.

Awards under the 2006 Plan may be conditioned on continued employment, the passage of time or the

satisfaction of performance vesting criteria. An aggregate of 14,000,000 shares is reserved for issuance under the

2006 Plan. As of March 31, 2007, a total of 12,006,900 shares were available for issuance under this plan.

Under the 1996 Plan, the Company granted options for shares. Options issued under the 1996 Plan generally

vest over four years and remain outstanding for periods not to exceed ten years. Options were granted at exercise

prices of at least 100% of the fair market value of the shares on the date of grant. The Company made no grants

of restricted shares, stock appreciation rights or stock units under the 1996 Plan. No further awards will be

granted under the 1996 Plan.

Under the 1988 Stock Option Plan, options to purchase shares were granted to employees and consultants at

exercise prices ranging from zero to amounts in excess of the fair market value of the shares on the date of grant.

The terms and conditions with respect to options granted were determined by the Board of Directors who

administered this plan. Options generally vested over four years and remained outstanding for periods not

exceeding ten years. Further grants may not be made under this plan and as of March 31, 2007, there were no

options outstanding under this plan.

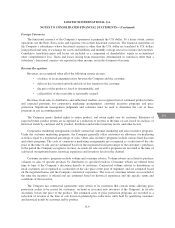

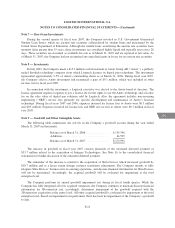

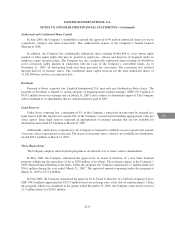

Impact of SFAS 123R Adoption

Effective April 1, 2006, the Company adopted SFAS 123R using the modified prospective method, which

requires the measurement and recognition of compensation expense based on estimated fair values for all share-based

payment awards made to employees and directors, including stock options and share purchases under the 2006 ESPP

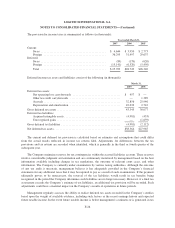

and 1996 ESPP. The following table summarizes the share-based compensation expense and related tax benefit

recognized in accordance with SFAS 123R for fiscal year 2007 (in thousands). In accordance with APB 25 and related

previous accounting standards, no share-based compensation expense was recognized for fiscal years 2006 and 2005.

Year Ended

March 31, 2007

Cost of goods sold ...................................................... $ 2,077

Share – based compensation expense included in gross profit .................... 2,077

Operating expenses:

Marketing and selling ............................................... 7,167

Research and development ............................................ 3,151

General and administrative ........................................... 7,069

Share-based compensation expense included in operating expenses ............... 17,387

Total share-based compensation expense related to employee stock options and

employee stock purchases .............................................. 19,464

Tax benefit ............................................................ 4,526

Share-based compensation expense related to employee stock options and employee

stock purchases, net of tax .............................................. $14,938

F-16