Logitech 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our expansion in streaming media systems may present risks that could adversely affect the valuation of

assets acquired and impact our operating results.

In October 2006, we acquired Slim Devices, Inc., a privately held company specializing in network-based

audio systems for digital music. Slim Devices’ products compete in the emerging market for network-based

music systems. As with any emerging market, uncertainty exists concerning whether and how quickly the market

will develop and evolve. Factors such as these and others could prevent us from realizing the anticipated benefits

of the acquisition.

The Slim Devices acquisition resulted in the recording of goodwill, which could result in potential

impairment charges that could adversely affect our operating results. Acquisitions are inherently risky, and no

assurance can be given that our acquisition of Slim Devices or other future acquisitions will be successful and

will not adversely affect our business, operating results or financial condition.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

Logitech International S.A. was incorporated under the laws of Switzerland in 1981 as a company with

indefinite duration. Our shares are listed on the SWX Swiss Exchange and the Nasdaq Global Select Market. Our

registered office is CH-1143 Apples, Switzerland; and the telephone number is 41-(0)21-800-53-54. We have

manufacturing facilities in Asia and offices in major cities in North America, Europe and Asia Pacific.

Important Events

Share for ADS Exchange

In October 2006, we exchanged our Logitech shares for our Nasdaq-listed American Depositary Shares

(“ADSs”) on a one-for-one basis, so that the same Logitech shares trade on the Nasdaq Global Select Market as

on the SWX Swiss Exchange. Effective February 2007, Logitech became part of the Nasdaq-100 Index®and the

Nasdaq-100 Equal Weighted IndexSM. Our shares also became part of the Nasdaq-100 Index Tracking Stock®.

Sales Growth and Acquisitions

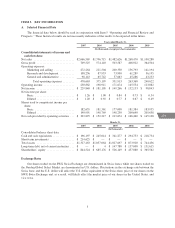

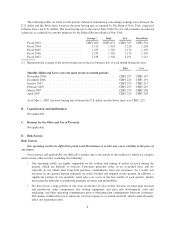

During the past few years, we have significantly broadened our product offerings and the markets in which

we sell them. During the same period, our net sales have grown significantly, from $736 million in fiscal year

2001 to $2.1 billion in fiscal year 2007. Most of this growth has been organic, a result of the Company’s own

product development and marketing activities. However, our business has also grown as a result of a limited

number of acquisitions that have expanded our activities into new product categories.

Slim Devices – Streaming Media Systems. In October 2006, we acquired Slim Devices, Inc. (“Slim

Devices”), a privately held company specializing in network-based audio systems for digital music, based in

Mountain View, California. We paid $20.0 million in cash for all the outstanding shares of Slim Devices, and

$0.6 million in closing and transaction costs. We also agreed to a possible performance-based payment, payable

in the first calendar quarter of 2010, based on net revenues in calendar year 2009 from the sale of products and

services derived from Slim Devices’ technology. The acquisition is part of our strategy to expand our presence in

the digital music and home-entertainment control environment.

Intrigue – Advanced Remote Controls. In May 2004, we acquired Intrigue Technologies, Inc. (“Intrigue”), a

privately held provider of advanced remote controls, based in Mississauga, Canada. Under the terms of the

purchase agreement, we acquired all the outstanding shares of Intrigue for $29.8 million in cash, and $1.6 million

in closing and transaction costs, plus a deferred payment, estimated at March 31, 2007 to be at least

$33.7 million, to Intrigue’s former shareholders based on the highest net sales from products incorporating

Intrigue’s technology during any consecutive four-quarter period from April 2006 through September 2007. The

acquisition was part of our strategy to pursue new opportunities in the living room environment, positioning

Logitech at the convergence of consumer electronics and personal computing in the digital living room.

13

CG