Logitech 2007 Annual Report Download - page 60

Download and view the complete annual report

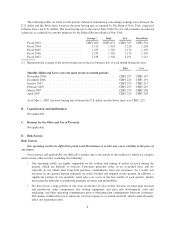

Please find page 60 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.market, and a trend of declining average selling prices in the OEM market. We continue to experience aggressive

price competition and other promotional activities from our primary competitors and from less-established

brands, and we may choose to adjust prices or increase other promotional activities to improve our competitive

position. We may also encounter more competition if any of our competitors decide to enter other markets in

which we currently operate.

In addition, we have been expanding the categories of products we sell, and entering new markets, such as

the market for programmable remote controls and streaming media devices. As we do so, we are confronting new

competitors, many of which have more experience in the categories or markets and have greater marketing

resources and brand name recognition than we have. In addition, because of the continuing convergence of the

markets for computing devices and consumer electronics, we expect greater competition in the future from well-

established consumer electronics companies in our developing categories, as well as future ones we might enter.

Many of these companies have greater financial, technical, sales, marketing and other resources than we have.

We expect continued competitive pressure in both our retail and OEM business, including in the terms and

conditions that our competitors offer customers, which may be more favorable than our terms and conditions and

may require us to take actions to increase our customer incentive programs, which could impact our revenues and

operating margins.

Corded and Cordless. Microsoft is our main competitor in retail cordless (mice and desktops) and corded

(mice and keyboards) categories. Microsoft’s offerings include a complete line of mice, keyboards and desktops.

Microsoft has significantly greater financial, technical, sales, marketing and other resources, as well as greater

name recognition and a larger customer base. We are also experiencing competition and pricing pressure for

corded and cordless mice and desktops from less-established brands, in the lower-price segments, which could

potentially impact our market share. The emerging notebook peripheral segment is also an area where we face

aggressive pricing and promotions, as well as new competitors that have broader notebook product offerings than

we do.

Video. Our competitors for PC Web cameras include Creative Labs, Philips and Microsoft, whose entry into

the product category made the competitive environment more intense. We are encountering aggressive pricing

practices, promotions and channel marketing on a worldwide basis, which may impact our revenues and

margins.

Microsoft is a leading producer of operating systems and applications with which our mice, keyboards and

webcams are designed to operate. As a result, Microsoft may be able to improve the functionality of its own

peripherals to correspond with ongoing enhancements to its operating systems and software applications before

we are able to make such improvements. This ability could provide Microsoft with significant lead-time

advantages. In addition, Microsoft may be able to offer pricing advantages on bundled hardware and software

products that we may not be able to offer.

Gaming. Competitors for our interactive entertainment products include Intec, Mad Catz, Pelican

Accessories and Saitek Industries. Our controllers for PlayStation®also compete against controllers offered by

Sony.

Audio. Competitors in audio devices vary by product line. In the PC, mobile entertainment and

communication platform speaker business, competitors include Plantronics and its Altec Lansing subsidiary,

Creative Labs, and Bose Corporation. In the PC and console headset, telephony and microphone business, our

main competitors include Plantronics and its Altec Lansing subsidiary. With the acquisition of Slim Devices in

October 2006, we expanded our audio product portfolio to include network-based audio systems for digital

music. This is an emerging market, with several small competitors, as well as larger established consumer

electronics companies, like Sony and Philips.

Advanced Remote Controls. Our revenues and market share for personal peripheral devices for home

entertainment systems have expanded substantially in the last year. With many companies offering universal

8