Logitech 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have historically targeted peripherals for the PC platform, a market that is dynamically changing as a

result of consumer trends toward notebooks and other mobile devices. We remain focused on strengthening our

leadership in the PC peripherals market through the introduction of products that support the continued growth of

the notebook market segment. We have also expanded into peripherals for other platforms, including video game

consoles, mobile phones, home entertainment systems and mobile entertainment and digital music systems.

Logitech’s markets are extremely competitive and are characterized by short product life cycles, rapidly

changing technology, evolving customer demands, and aggressive promotional and pricing practices. In order to

remain competitive, we believe continued investment in product research and development is critical to driving

innovation with new and improved products and technologies. We are committed to meeting customer needs for

personal peripheral devices and believe innovation and product quality are important to gaining market

acceptance and strengthening market leadership.

Over the last several years, Logitech has created a foundation for long-term growth, by expanding and

improving our supply chain operations, investing in product development and marketing, delivering innovative

new products and pursuing new market opportunities. We have significantly broadened our product offerings and

the markets in which we sell. Our expansion has been primarily organic, but we have also grown as a result of a

limited number of acquisitions that expanded our business into new product categories.

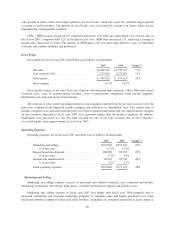

In fiscal year 2007, revenues increased 15% to $2.1 billion and net income increased 27% to $229.8 million,

reflecting our 2007 focus on capturing growth opportunities and improving profitability. We achieved continued

growth in all major product categories, an indication of the strength of our product portfolio. Cordless mice and

desktops, audio and Harmony remote control retail sales were key growth categories contributing to the

Company’s fiscal 2007 financial performance. We also achieved strong gross margin improvements through our

emphasis on driving product innovation and controlling and reducing our product cost structure. We also

invested in business applications and information technology to improve our operational and financial processes.

Our strategy for fiscal year 2008 remains to position Logitech as a premium supplier in our product

categories, offering affordable luxury to the consumer while continuing to compete aggressively in all market

segments, from the entry level through the high-end. To implement this strategy, our focus will include continued

growth through innovative new products and enhanced scalability of operations. We plan to expand our

successful line of peripherals for the notebook platform, particularly with new cordless mice and products similar

to the Logitech Alto notebook stand. We have a number of innovative keyboards and desktops planned for

desktop PC users. We will also introduce major navigation innovation in the pointing device category. In the

digital music arena, we plan to introduce new PC and iPod®speakers for all major price points, and leverage the

opportunities provided by our Slim Devices acquisition in the wireless streaming of digital content. Innovative

new gaming products and the continued expansion of the Harmony remote control product line are also in our

plans for fiscal year 2008. To support our planned growth, we intend to scale our processes to handle the

increased complexity of our product line and improve the product life cycle management process. We also intend

to manage our operating expenses in line with our gross profit growth for the year.

Critical Accounting Estimates

The preparation of financial statements and related disclosures in conformity with generally accepted

accounting principles in the United States of America (“U.S. GAAP”) and in compliance with relevant Swiss law

requires the Company to make judgments, estimates and assumptions that affect reported amounts of assets,

liabilities, net sales and expenses, and the disclosure of contingent assets and liabilities.

We consider an accounting estimate critical if it: (i) requires management to make judgments and estimates

about matters that are inherently uncertain; and (ii) is important to an understanding of Logitech’s financial

condition and operating results.

33

CG