Dollar Tree 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also plan to operate Better Stores. I am particularly pleased that average new store

sales per square foot increased once again in 2012, to the highest level since 2001. New store

productivity has now increased each year for seven consecutive years. is improvement has

been a team effort.

Our Real Estate department is focused on improved site-selection and right-sizing

our stores to the market.

Our Merchants are working to develop more productive floor plans and expanding

assortments with a focus on the most productive categories of merchandise.

And our Field organization is opening stores faster and more efficiently through

improved staffing and building the bench of qualified store management.

ese have been the key elements to increasing our new store productivity and we

expect this to continue.

Elements of the strategy to increase store productivity can be seen in both new and

existing stores throughout the chain. Customers are seeing more powerful Seasonal

presentations, which create interest and a fun shopping experience. We are expanding

assortments in several categories including Candy, Stationery, Health and Beauty Care, and

Home and Household Products to enhance our relevance to our customers. We have re-

fixtured, re-merchandised and expanded assortments at the front end of our stores to create

more merchandise energy and to drive impulse sales. Our store associates are emphasizing

friendliness, with more effective customer engagement, and driving sales of related items

through cross merchandising and suggestive selling.

Our expansion of frozen and refrigerated product continues. We installed freezers and

coolers in 329 stores in 2012, including 190 new stores – exceeding our goal of 325

installations. We now offer frozen and refrigerated product in 2,549 stores. is important

category is extremely productive. It serves the current needs of our customers, drives traffic

into our stores and provides incremental sales across all categories – including our higher-

margin discretionary product. We plan to expand frozen and refrigerated product to an

additional 475 stores this year.

Another key component of our Growth strategy is the development of new retail formats, the

expansion of our geographic reach and the development of additional channels of distribution.

Specifically, that means Deals, Dollar Tree Canada and Dollar Tree Direct.

Our Deals format extends our ability to serve more customers with more categories and

increases our unit growth potential. Deals stores deliver low prices on everyday essentials,

party goods, seasonal and home products. By lifting the restriction of the $1 price point

at Deals we are able to serve more customers with more products at value prices every day.

Our goal is to surprise and delight our customers with every visit. Awareness of the Deals

brand is growing and the concept is building momentum. I am excited about the growth

2012 Annual Report 3

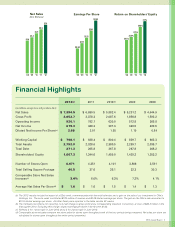

We have increased our relevance throughout inflationary and deflationary

cycles... leveraging our scale and flexibility... maintaining our focus on

achieving our margin targets and providing extreme value to our customers...

‘08 ‘09 ‘10 ‘11 ‘12

10.7%

11.8%12.4%

9.8%

7. 9%

Operating Margin

‘08 ‘09 ‘10 ‘11 ‘12

4.17 4.22 4.25

4.06

3.80

Inventory Turns