Dollar Tree 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Revenue Recognition

eCompanyrecognizessalesrevenueatthetimeasale

is made to its customer.

Taxes Collected

e Company reports taxes assessed by a governmental

authority that are directly imposed on revenue-producing

transactions(i.e.,salestax)onanet(excludedfrom

revenues)basis.

Cost of Sales

e Company includes the cost of merchandise, ware-

housing and distribution costs, and certain occupancy

costs in cost of sales.

Pre-Opening Costs

e Company expenses pre-opening costs for new,

expanded and relocated stores, as incurred.

Advertising Costs

e Company expenses advertising costs as they are

incurred and they are included in “selling, general

and administrative expenses” on the accompanying

consolidated statements of operations. Advertising costs

approximated$13.5million,$13.8millionand$11.1

millionfortheyearsendedFebruary2,2013,January28,

2012,andJanuary29,2011,respectively.

Income Taxes

Income taxes are accounted for under the asset and

liability method. Deferred tax assets and liabilities are

recognizedforthefuturetaxconsequencesattributableto

dierencesbetweennancialstatementcarryingamounts

of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable

incomeintheyearsinwhichthosetemporarydierences

areexpectedtoberecoveredorsettled.eeecton

deferred tax assets and liabilities of a change in tax rates

isrecognizedinincomeintheperiodthatincludesthe

enactment date of such change.

eCompanyrecognizesanancialstatement

benetforataxpositionifitdeterminesthatitismore

likely than not that the position will be sustained upon

examination.

e Company includes interest and penalties in

the provision for income tax expense and income taxes

payable. e Company does not provide for any penalties

associated with tax contingencies unless they are consid-

ered probable of assessment.

Stock-Based Compensation

eCompanyrecognizesallshare-basedpaymentsto

employees, including grants of employee stock options, in

thenancialstatementsbasedontheirfairvalues.Total

stock-basedcompensationexpensefor2012,2011and

2010was$34.9million,$31.0millionand$27.9million,

respectively.

eCompanyrecognizesexpenserelatedtothefair

valueofstockoptionsandrestrictedstockunits(RSUs)

over the requisite service period on a straight-line basis or

a shorter period based on the retirement eligibility of the

grantee. e fair value of stock option grants is estimated

on the date of grant using the Black-Scholes option

pricing model. e fair value of the RSUs is determined

usingtheclosingpriceoftheCompany’scommonstock

on the date of grant.

Net Income Per Share

Basic net income per share has been computed by

dividing net income by the weighted average number

of shares outstanding. Diluted net income per share

reflects the potential dilution that could occur assuming

the inclusion of dilutive potential shares and has been

computed by dividing net income by the weighted

average number of shares and dilutive potential shares

outstanding. Dilutive potential shares include all

outstanding stock options and unvested RSUs after

applying the treasury stock method.

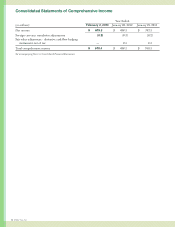

Comprehensive Income

Intherstquarterof2012,theCompanyadopted

AccountingStandardsUpdate(“ASU”)No.2011-05,

“ComprehensiveIncome(Topic220):Presentationof

Comprehensive Income.” is update requires that the

total of comprehensive income, the components of net

income, and the components of other comprehensive

income be presented in either a single continuous

statement of comprehensive income or in two separate

but consecutive statements. is update does not change

what items are reported in other comprehensive income

ortherequirementtoreportreclassicationofitems

from other comprehensive income to net income.

2012AnnualReport35