Dollar Tree 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

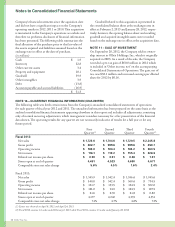

Notes to Consolidated Financial Statements

Deferredincometaxesreectthenettaxeectsoftemporarydierencesbetweenthecarryingamountsofassets

andliabilitiesfornancialreportingpurposesandtheamountsusedforincometaxpurposes.Deferredtaxassetsand

liabilitiesareclassiedontheaccompanyingconsolidatedbalancesheetsbasedontheclassicationoftheunderlying

assetorliability.SignicantcomponentsoftheCompany’snetdeferredtaxassets(liabilities)follow:

(in millions) February 2, 2013 January28,2012

Deferred tax assets:

Deferred rent $ 35.6 $ 31.5

Accrued expenses

32.6 31.4

Netoperatinglossesandcreditcarryforwards

14.4

9.1

Accrued compensation expense

28.2

27.0

Other

0.8

1.5

Total deferred tax assets

111.6

100.5

Valuationallowance

(4.3)

(3.5)

Deferred tax assets, net

107.3

97.0

Deferred tax liabilities:

Property and equipment

(32.8)

(34.0)

Goodwill

(15.9)

(15.1)

Prepaid expenses

(4.0)

(0.4)

Inventory

(3.8)

(4.5)

Total deferred tax liabilities

(56.5)

(54.0)

Netdeferredtaxasset $ 50.8 $ 43.0

Avaluationallowanceof$4.3million,netoffederal

taxbenets,hasbeenprovidedprincipallyforcertainstate

credit carryforwards and net operating loss carryforwards.

Inassessingtherealizabilityofdeferredtaxassets,the

Company considers whether it is more likely than not

that some portion or all of the deferred taxes will not

berealized.Basedupontheavailabilityofcarrybacksof

futuredeductibleamountstothepasttwoyears’taxable

incomeandtheCompany’sprojectionsforfuturetaxable

income over the periods in which the deferred tax assets

are deductible, the Company believes it is more likely than

nottheremainingexistingdeductibletemporarydierences

will reverse during periods in which carrybacks are available

or in which the Company generates net taxable income.

e company is participating in the Internal Revenue

Service(“IRS”)ComplianceAssuranceProgram(“CAP”)

forthe2012scalyearandhasappliedtoparticipatefor

scalyear2013.isprogramacceleratestheexamination

of key transactions with the goal of resolving any issues

beforethetaxreturnisled.Ourfederaltaxreturns

have been examined and all issues have been settled

throughourscal2011taxyear.Inaddition,severalstates

completedtheirexaminationduringscal2012.Fiscal

years2010andforwardarewithinthestatuteoflimita-

tions for state tax purposes. e statute of limitations is

stillopenpriorto2010forsomestates.

38 Dollar Tree, Inc.