Dollar Tree 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interest Rate Risk

Weusevariable-ratedebttonancecertainofouropera-

tions and capital improvements. ese obligations expose

us to variability in interest payments due to changes in

interest rates. If interest rates increase, interest expense

increases. Conversely, if interest rates decrease, interest

expensealsodecreases.Webelieveitisbenecialtolimit

the variability of our interest payments.

Tomeetthisobjective,weenteredintoderivative

instrumentsintheformoftwo$75.0millioninterest

rateswapsinMarch2008tomanageuctuationsincash

flows resulting from changes in the variable-interest rates

onaportionofour2008$250.0milliontermloan.e

interest rate swaps reduced the interest rate exposure

on these variable-rate obligations. Under the interest

rateswaps,wepaidthebankataxed-rateandreceived

variable-interest at a rate approximating the variable-

rate on the obligation, thereby creating the economic

equivalentofaxed-rateobligation.eseswapsexpired

inMarch2011.

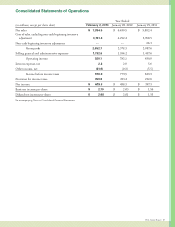

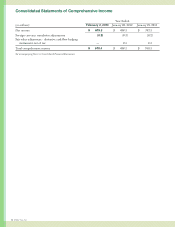

Management’s Discussion & Analysis of

Financial Condition and Results of Operations

2012AnnualReport25