Dollar Tree 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

the retirement eligibility of the grantee. e Company

recognized$0.9millionand$5.4millionofexpense

relatedtotheseRSUsin2012and2011,respectively.

e fair value of these RSUs was determined using the

Company’sclosingstockpriceonthegrantdate.

In2010,theCompanygranted0.4millionRSUs

fromtheEIPandtheEOEPtocertainocersofthe

Company, contingent on the Company meeting certain

performancetargetsin2010andfutureserviceofthese

ocersthroughMarch2013.eCompanymetthese

performancetargetsinscal2010;therefore,thefair

valueoftheseRSUsof$7.8millionisbeingexpensed

over the service period or a shorter period based on

the retirement eligibility of the grantee. e Company

recognized$1.0million,$1.8millionand$4.8millionof

expenserelatedtotheseRSUsin2012,2011and2010,

respectively. e fair value of these RSUs was determined

usingtheCompany’sclosingstockpriceonthegrantdate.

In2012,theCompanygrantedRSUswithan

estimatedvalueof$1.7millionfromtheOmnibusPlan

tocertainocersoftheCompany.Eachocerhasthe

opportunitytoearnanamountbetweenzeropercent

(0%)andtwohundredpercent(200%)oftheindividual

target award contingent on the Company meeting certain

performance targets for the period beginning on January

29,2012andendingonJanuary31,2015.Providingthe

vestingconditionsaresatised,theawardswillvestatthe

end of the performance period. e estimated value is

being expensed over the performance period or a shorter

period based on the retirement eligibility of the grantee.

eCompanyrecognized$1.0millionofexpenserelated

totheseRSUsin2012.eestimatedvalueofthese

RSUswasdeterminedusingtheCompany’sclosingstock

price on the grant date.

In2011,theCompanygrantedRSUswithan

estimatedvalueof$0.7millionfromtheOmnibusPlan

tocertainocersoftheCompany.Eachocerhasthe

opportunitytoearnanamountbetweenzeropercent

(0%)andtwohundredpercent(200%)oftheindividual

target award contingent on the Company meeting certain

performance targets for the period beginning on January

30,2011andendingonFebruary1,2014.Providingthe

vestingconditionsaresatised,theawardswillvestatthe

end of the performance period. e estimated value is

being expensed over the performance period or a shorter

period based on the retirement eligibility of the grantee.

eCompanyrecognized$0.2millionand$0.4million

ofexpenserelatedontheseRSUsin2012and2011,

respectively. e estimated value of these RSUs was

determinedusingtheCompany’sclosingstockpriceon

the grant date.

In2012,theCompanygranted0.2millionRSUs

withafairvalueof$10.0millionfromtheOmnibus

PlantotheChiefExecutiveOceroftheCompany,

contingent on the Company meeting certain performance

targetsfortheperiodbeginningJuly29,2012andending

onAugust3,2013andthegranteecompletingave-year

service requirement. e fair value of these RSUs is

beingexpensedratablyovertheve-yearvestingperiod.

eCompanyrecognized$1.3millionofexpenserelated

totheseRSUsin2012.efairvalueoftheseRSUswas

determinedusingtheCompany’sclosingstockpriceon

the grant date.

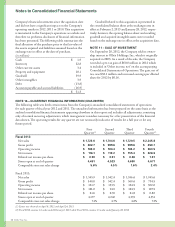

efollowingtablesummarizesthestatusof

RSUsasofFebruary2,2013,andchangesduringthe

year then ended:

Shares

Weighted

Average

Grant

Date Fair

Value

NonvestedatJanuary28,2012

2,511,450 $ 22.49

Granted 933,346 48.43

Vested (1,315,755) 20.24

Forfeited (74,868) 31.41

NonvestedatFebruary2,2013

2,054,173 $ 35.37

InconnectionwiththevestingofRSUsin2012,

2011and2010,certainemployeeselectedtoreceive

shares net of minimum statutory tax withholding

amountswhichtotaled$22.1million,$13.2million

and$11.1million,respectively.etotalfairvalue

of the restricted shares vested during the years ended

February2,2013,January28,2012andJanuary29,

2011was$26.6million,$20.9millionand$19.1million,

respectively.

Stock Options

In2012,2011and2010,theCompanygrantedless

than0.1millionservicebasedstockoptionsfromthe

OmnibusPlan,EIP,EOPandtheNEDP,respectively.

All options granted to directors vest immediately and

areexpensedonthegrantdate.During2012,2011and

2010,theCompanyrecognized$1.2million,$1.1million

and$2.3million,respectivelyofexpenserelatedto

service-based stock option grants.

efollowingtablessummarizetheCompany’s

various option plans and information about options

outstandingatFebruary2,2013andchangesduringthe

year then ended.

46 Dollar Tree, Inc.