Dollar Tree 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

under “other income, net” on the accompanying consoli-

dated statements of operations. e fair value of these

contractsatFebruary2,2013wasanassetof$0.5million.

In2008,theCompanyenteredintotwo$75.0

million interest rate swap agreements. ese interest

rate swaps were used to manage the risk associated with

interestrateuctuationsonaportionoftheCompany’s

NOTE 7—SHAREHOLDERS’ EQUITY

Preferred Stock

eCompanyisauthorizedtoissue10,000,000sharesofPreferredStock,$0.01parvaluepershare.Nopreferredshares

areissuedandoutstandingatFebruary2,2013andJanuary28,2012.

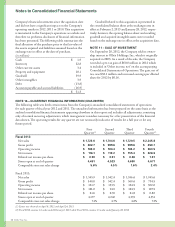

Net Income Per Share

e following table sets forth the calculation of basic and diluted net income per share:

(in millions, except per share data)

YearEnded

February 2, 2013

January28,2012 January29,2011

Basic net income per share:

Netincome $ 619.3 $ 488.3 $ 397.3

Weightedaveragenumberofsharesoutstanding 229.3 240.6 254.1

Basic net income per share $ 2.70 $ 2.03 $ 1.56

Diluted net income per share:

Netincome $ 619.3 $ 488.3 $ 397.3

Weightedaveragenumberofsharesoutstanding 229.3 240.6 254.1

Dilutiveeectofstockoptionsandrestrictedstock

(asdeterminedbyapplyingthetreasurystockmethod)

1.4 1.8 1.9

Weightedaveragenumberofsharesanddilutive

potential shares outstanding 230.7 242.4 256.0

Diluted net income per share $ 2.68 $ 2.01 $ 1.55

AtFebruary2,2013,January28,2012andJanuary29,2011,substantiallyallofthestockoptionsoutstanding

were included in the calculation of the weighted average number of shares and dilutive potential shares outstanding.

variable rate debt. Under these agreements, the Company

paidinteresttonancialinstitutionsataxedrateof

2.8%.Inexchange,thenancialinstitutionspaidthe

Company at a variable rate, which equals the variable rate

on the debt, excluding the credit spread. ese swaps

qualiedforhedgeaccountingtreatmentandexpiredin

March2011.

Share Repurchase Programs

e Company repurchases shares on the open market

and under Accelerated Share Repurchase agreements.

On the open market, the Company repurchased

7.7millionsharesfor$340.2millioninscal2012.

eCompanyrepurchased5.3millionsharesfor

$145.9millioninscal2011.eCompanyrepurchased

8.7millionsharesfor$214.7millioninscal2010.

AtFebruary2,2013,theCompanyhad$859.8million

remainingunderBoardauthorization.

OnNovember21,2011,theCompanyentered

intoanagreementtorepurchase$300.0millionofthe

Company’scommonsharesundera“collared”Accelerated

ShareRepurchaseAgreement(ASR).Underthisagree-

ment,theCompanyinitiallyreceived6.8millionshares

throughDecember13,2011,representingtheminimum

number of shares to be received based on a calculation

using the “cap” or high-end of the price range of the

“collar.”eASRconcludedonMarch28,2012andthe

Companyreceivedanadditional0.5millionsharesunder

the“collared”agreementresultingin7.3milliontotal

shares being repurchased under this ASR. e number

of shares is determined based on the weighted average

marketpriceoftheCompany’scommonstock,lessa

discount,duringaspeciedperiodoftime.

OnAugust24,2011,theCompanyenteredinto

anagreementtorepurchase$200.0millionofthe

Company’scommonsharesundera“collared”ASR.

Under this agreement, the Company initially received 5.1

millionsharesthroughSeptember2,2011,representing

the minimum number of shares to be received based on a

calculation using the “cap” or high-end of the price range

ofthe“collar.”eASRconcludedonNovember15,

2011andtheCompanyreceivedanadditional0.3

2012AnnualReport43