Dollar Tree 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

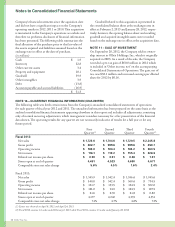

Notes to Consolidated Financial Statements

receivedawardsundertheEIP.eEOEPallowedthe

Company to grant the same type of equity awards as the

EIP.eseawardsgenerallyvestoverathree-yearperiod,

withamaximumtermof10years.isplanwastermi-

natedonJune16,2011andreplacedwiththeCompany’s

OmnibusIncentivePlan(OmnibusPlan).

Stock appreciation rights may be awarded alone or in

tandemwithstockoptions.Whenthestockappreciation

rights are exercisable, the holder may surrender all or a

portion of the unexercised stock appreciation right and

receive in exchange an amount equal to the excess of

the fair market value at the date of exercise over the fair

marketvalueatthedateofthegrant.Nostockapprecia-

tion rights have been granted to date.

AnyrestrictedstockorRSUsawardedaresubjectto

certain general restrictions. e restricted stock shares or

units may not be sold, transferred, pledged or disposed

of until the restrictions on the shares or units have lapsed

or have been removed under the provisions of the plan.

In addition, if a holder of restricted shares or units ceases

to be employed by the Company, any shares or units in

which the restrictions have not lapsed will be forfeited.

e2003Non-EmployeeDirectorStockOption

Plan(NEDP)providednon-qualiedstockoptions

tonon-employeemembersoftheCompany’sBoardof

Directors. e stock options were functionally equivalent

tosuchoptionsissuedundertheEIPdiscussedabove.e

exercise price of each stock option granted equaled the

closingmarketpriceoftheCompany’sstockonthedateof

grant. e options generally vested immediately. is plan

wasterminatedonJune16,2011andreplacedwiththe

Company’sOmnibusIncentivePlan(OmnibusPlan).

e2003DirectorDeferredCompensationPlan

permitsanyoftheCompany’sdirectorswhoreceivea

retainer or other fees for Board or Board committee

service to defer all or a portion of such fees until a future

date, at which time they may be paid in cash or shares of

theCompany’scommonstock,orreceivealloraportion

of such fees in non-statutory stock options. Deferred fees

thatarepaidoutincashwillearninterestatthe30-year

Treasury Bond Rate. If a director elects to be paid in

common stock, the number of shares will be determined

by dividing the deferred fee amount by the closing market

priceofashareoftheCompany’scommonstockon

the date of deferral. e number of options issued to a

director will equal the deferred fee amount divided by

33%ofthepriceofashareoftheCompany’scommon

stock. e exercise price will equal the fair market value

oftheCompany’scommonstockatthedatetheoptionis

issued. e options are fully vested when issued and have

atermof10years.

Under the Omnibus Plan, the Company may grant

upto4.0millionsharesofitsCommonStock,plusany

sharesavailableforfutureawardsundertheEIP,EOEP,

orNEDPplans,totheCompany’semployees,including

executive officers and independent contractors. e

Omnibus Plan permits the Company to grant equity

awards in the form of incentive stock options, nonquali-

edstockoptions,stockappreciationrights,restricted

stock awards, restricted stock units, performance

bonuses, performance units, non-employee director stock

options and other equity-related awards. ese awards

generally vest over a three-year period with a maximum

termof10years.

Restricted Stock

eCompanygranted0.5million,0.7millionand1.1

millionservice-basedRSUs,netofforfeituresin2012,

2011and2010,respectively,fromtheOmnibusPlan,

EIPandtheEOEPtotheCompany’semployeesand

officers. e fair value of all of these RSUs is being

expensed ratably over the three-year vesting periods,

or a shorter period based on the retirement eligibility

of the grantee. e fair value was determined using the

Company’sclosingstockpriceonthedateofgrant.e

Companyrecognized$21.9million,$19.2millionand

$17.3millionofexpenserelatedtotheseRSUsduring

2012,2011and2010,respectively.AsofFebruary

2,2013,therewasapproximately$21.8millionof

totalunrecognizedcompensationexpenserelatedto

theseRSUswhichisexpectedtoberecognizedovera

weighted-averageperiodof21months.

In2012,theCompanygranted0.2millionRSUs

from the Omnibus Plan to certain officers of the

Company, contingent on the Company meeting certain

performancetargetsin2012andfutureserviceofthese

ocersthroughMarch2015.eCompanymetthese

performancetargetsinscal2012;therefore,thefairvalue

oftheseRSUsof$8.1millionisbeingexpensedoverthe

service period or a shorter period based on the retirement

eligibilityofthegrantee.eCompanyrecognized$5.7

millionofexpenserelatedtotheseRSUsin2012.efair

valueoftheseRSUswasdeterminedusingtheCompany’s

closing stock price on the grant date.

In2011,theCompanygranted0.3millionRSUs

fromtheEIPandtheEOEPtocertainocersofthe

Company, contingent on the Company meeting certain

performancetargetsin2011andfutureserviceofthese

ocersthroughMarch2014.eCompanymetthese

performancetargetsinscal2011;therefore,thefair

valueoftheseRSUsof$7.3millionisbeingexpensed

over the service period or a shorter period based on

2012AnnualReport45