Dollar Tree 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

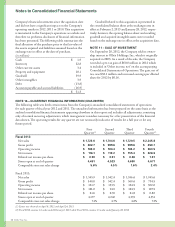

Notes to Consolidated Financial Statements

ebalanceforunrecognizedtaxbenetsat

February2,2013,was$5.6million.etotalamountof

unrecognizedtaxbenetsatFebruary2,2013,that,if

recognized,wouldaecttheeectivetaxratewas$3.7

million(netofthefederaltaxbenet).efollowingisa

reconciliationoftheCompany’stotalgrossunrecognized

taxbenetsfortheyearendedFebruary2,2013:

(in millions)

BalanceatJanuary28,2012 $ 15.5

Additions, based on tax positions

related to current year 2.5

Additions for tax positions of

prior years 2.1

Reductions for tax positions of

prior years (3.1)

Settlements (1.9)

Lapses in statutes of limitations (9.5)

BalanceatFebruary2,2013 $ 5.6

Duringscal2012,theCompanyaccruedpotential

interestof$0.2million,relatedtotheseunrecognizedtax

benets.Nopotentialpenaltieswereaccruedduring2012

relatedtotheunrecognizedtaxbenets.AsofFebruary2,

2013,theCompanyhasrecordedaliabilityforpotential

interestof$0.4million.

It is possible that state tax reserves will be reduced for

audit settlements and statute expirations within the next

12months.Atthispointitisnotpossibletoestimatea

range associated with the resolution of these audits.

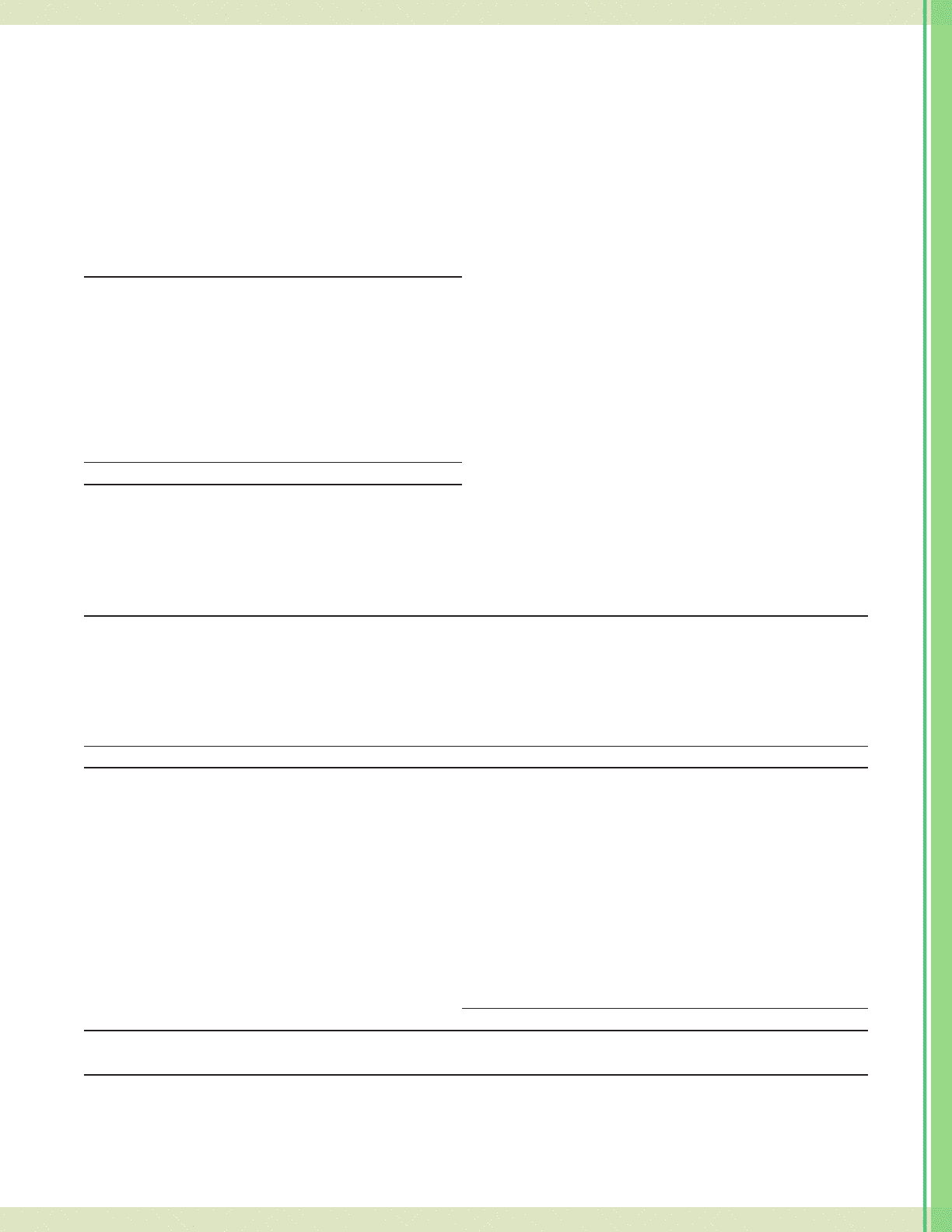

NOTE 4—COMMITMENTS AND CONTINGENCIES

Operating Lease Commitments

Future minimum lease payments under noncancelable store and distribution center operating leases are as follows:

(in millions)

2013 $ 493.8

2014 408.8

2015 376.4

2016 293.3

2017 207.6

ereafter 369.2

Total minimum lease payments $ 2,149.1

eabovefutureminimumleasepaymentsincludeamountsforleasesthatweresignedpriortoFebruary2,2013for

storesthatwerenotopenasofFebruary2,2013.

Minimumrentalpaymentsforoperatingleasesdonotincludecontingentrentalsthatmaybepaidundercertain

store leases based on a percentage of sales in excess of stipulated amounts. Future minimum lease payments have not

beenreducedbyexpectedfutureminimumsubleaserentalsof$1.2millionunderoperatingleases.

Minimum and Contingent Rentals

Rentalexpenseforstoreanddistributioncenteroperatingleases(includingpaymentstorelatedparties)includedinthe

accompanying consolidated statements of operations are as follows:

(in millions)

YearEnded

February 2, 2013 January28,2012 January29,2011

Minimumrentals $ 455.5 $ 421.8 $ 381.5

Contingent rentals 2.0 1.8 1.4

2012AnnualReport39