Dollar Tree 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

NOTE 3—INCOME TAXES

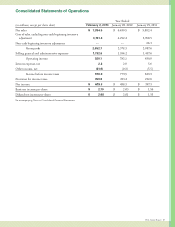

Total income taxes were allocated as follows:

(in millions)

YearEnded

February 2, 2013

January28,2012 January29,2011

Income from continuing operations $ 359.6 $ 291.2 $ 232.6

Accumulatedothercomprehensiveincome(loss)

markingderivativenancialinstrumentstofairvalue — (0.1) 1.3

Stockholders’equity,taxbenetonexercises/vesting

of equity-based compensation (21.3) (13.8) (7.8)

$ 338.3 $ 277.3 $ 226.1

e provision for income taxes consists of the following:

(in millions)

YearEnded

February 2, 2013

January28,2012 January29,2011

Federal - current 324.5 240.4 215.7

State - current 42.4 39.4 31.3

Foreign - current 0.5 0.3 —

Total current 367.4 280.1 247.0

Federal - deferred 0.3 14.9 (10.0)

State - deferred (3.5) 0.1 (4.4)

Foreign - deferred (4.6) (3.9) —

Total deferred (7.8) 11.1 (14.4)

IncludedincurrenttaxexpensefortheyearsendedFebruary2,2013,January28,2012andJanuary29,2011,are

amountsrelatedtouncertaintaxpositionsassociatedwithtemporarydierences.

Areconciliationofthestatutoryfederalincometaxrateandtheeectiveratefollows:

YearEnded

February 2, 2013

January28,2012 January29,2011

Statutory tax rate 35.0% 35.0% 35.0%

Eectof:

Sta te and local income taxes, net of federal

incometaxbenet 3.0 3.4 3.4

Other, net (1.3) (1.0) (1.5)

Eectivetaxrate

36.7% 37.4% 36.9%

eratereductionin“other,net”consistsprimarilyofbenetsfromtheresolutionoftaxuncertainties,intereston

taxreserves,federaljobscreditsandtax-exemptinterestosetbycertainnondeductibleexpenses.

United States income taxes have not been provided on accumulated but undistributed earnings of its foreign

subsidiaries as the company intends to permanently reinvest earnings.

2012AnnualReport37