Dollar Tree 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

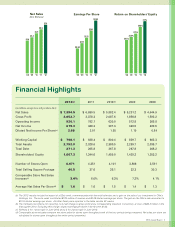

‘08 ‘09 ‘10 ‘11 ‘12

$5.9

$6.6

$7.4

$5.2

$4.6

Net Sales

($ in Billions)

‘08 ‘09 ‘10 ‘11 ‘12

$1.55

$2.01

$2.68

$1.19

$0.84

Earnings Per Share

‘08 ‘09 ‘10 ‘11 ‘12

27.5%

34.8%

41.1 %

23.9%

20.5%

Return on Shareholders’ Equi

ty

2012(a) 2011 2010(b) 2009 2008

(in millions, except store and per share data)

Net Sales $ 7,394.5 $ 6,630.5 $ 5,882.4 $ 5,231.2 $ 4,644.9

Gross Profit 2,652.7 2,378.3 2,087.6 1,856.8 1,592.2

Operating Income 920.1 782.1 630.0 512.8 365.8

Net Income 619.3 488.3 397.3 320.5 229.5

Diluted Net Income Per Share(c) 2.68 2.01 1.55 1.19 0.84

Working Capital $ 798.1 $ 628.4 $ 800.4 $ 829.7 $ 663.3

Total Assets 2,752.0 2,328.6 2,380.5 2,289.7 2,035.7

Total Debt 271.3 265.8 267.8 267.8 268.2

Shareholders’ Equity 1,667.3 1,344.6 1,459.0 1,429.2 1,253.2

Number of Stores Open 4,671 4,351 4,101 3,806 3,591

Total Selling Square Footage 40.5 37.6 35.1 32.3 30.3

Comparable Store Net Sales

Increase(c) 3.4% 6.0% 6.3% 7.2% 4.1%

Average Net Sales Per Store(d) $ 1.6 $ 1.6 $ 1.5 $ 1.4 $ 1.3

(a) The 2012 results include the impact of a 53rd week, commensurate with the retail calendar, and a gain on the sale of our investment in Ollie’s

Holdings, Inc. The extra week contributed $125 million of revenue and $0.08 diluted earnings per share. The gain on the Ollie’s sale amounted to

$0.16 diluted earnings per share. All other fiscal years reported in the table contain 52 weeks.

(b) The Company recorded a non-recurring, non-cash charge to gross profit and a corresponding reduction in inventory, at cost, of $26.3 million in the

first quarter 2010. Excluding this charge, diluted earnings per share in 2010 were $1.62.

(c) Reflects 2 for 1 stock split in June 2012 and a 3 for 2 stock split in June 2010.

(d) Comparable store net sales compare net store sales for stores open throughout each of the two periods being compared. Net sales per store are

calculated for stores open throughout the entire period presented.

Financial Highlights

2012 Annual Report 1