Dollar Tree 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

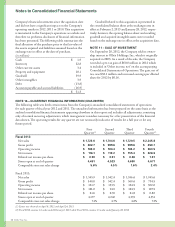

Notes to Consolidated Financial Statements

million shares under the “collared” agreement resulting

in5.4milliontotalsharesbeingrepurchasedunderthis

ASR. e number of shares is determined based on the

weightedaveragemarketpriceoftheCompany’scommon

stock,lessadiscount,duringaspeciedperiodoftime.

OnMarch19,2010,theCompanyenteredinto

anagreementtorepurchase$200.0millionofthe

Company’scommonsharesundera“collared”ASR.

Under this agreement, the Company initially received

9.2millionsharesthroughMarch31,2010,representing

the minimum number of shares to be received based on a

calculation using the “cap” or high-end of the price range

ofthecollar.eASRconcludedonAugust6,2010and

theCompanyreceivedanadditional0.8millionshares

underthe“collared”agreementresultingin10.0million

total shares being repurchased under this ASR. e

number of shares is determined based on the weighted

averagemarketpriceoftheCompany’scommonstock,

lessadiscount,duringaspeciedperiodoftime.

NOTE 8—EMPLOYEE BENEFIT PLANS

Profit Sharing and 401(k) Retirement Plan

eCompanymaintainsadenedcontributionprot

sharingand401(k)planwhichisavailabletoallemployees

over21yearsofagewhohavecompletedoneyearof

serviceinwhichtheyhaveworkedatleast1,000hours.

Eligibleemployeesmaymakeelectivesalarydeferrals.

e Company may make contributions at its discretion.

Contributions to and reimbursements by the Company

of expenses of the plan included in the accompanying

consolidated statements of operations were as follows:

Year Ended February 2, 2013 $40.7 million

YearEndedJanuary28,2012 37.9million

YearEndedJanuary29,2011 35.1million

EligibleemployeeshiredpriortoJanuary1,2007

areimmediatelyvestedintheCompany’sprotsharing

contributions.Eligibleemployeeshiredonorsubsequent

toJanuary1,2007vestintheCompany’sprotsharing

contributions based on the following schedule:

• 20%aftertwoyearsofservice

• 40%afterthreeyearsofservice

• 60%afterfouryearsofservice

• 100%afterveyearsofservice

All eligible employees are immediately vested in any

Companymatchcontributionsunderthe401(k)portion

of the plan.

Deferred Compensation Plan

e Company has a deferred compensation plan which

provides certain officers and executives the ability to defer

a portion of their base compensation and bonuses and

investtheirdeferredamounts.eplanisanonqualied

plan and the Company may make discretionary contribu-

tions. e deferred amounts and earnings thereon are

payabletoparticipants,ordesignatedbeneciaries,at

speciedfuturedates,oruponretirementordeath.Total

cumulativeparticipantdeferralswereapproximately$4.2

millionand$3.3million,respectively,atFebruary2,2013

andJanuary28,2012,andareincludedin“otherliabili-

ties” on the accompanying consolidated balance sheets.

e related assets are included in “other assets, net” on

the accompanying consolidated balance sheets. e

Company did not make any discretionary contributions

intheyearsendedFebruary2,2013,January28,2012,

orJanuary29,2011.

NOTE 9—STOCK-BASED COMPENSATION PLANS

AtFebruary2,2013,theCompanyhaseightstock-based

compensationplans.Eachplanandtheaccounting

method are described below.

Fixed Stock Option Compensation Plans

Underthe1995StockIncentivePlan(SIP),theCompany

granted options to its employees for the purchase of up

to37.8millionsharesofCommonStock.eexercise

price of each option equaled the market price of the

Company’sstockatthedateofgrant,unlessahigherprice

wasestablishedbytheBoardofDirectors,andanoption’s

maximumtermis10years.Optionsgrantedunderthe

SIP generally vested over a three-year period. is plan

wasterminatedonJuly1,2003andreplacedwiththe

Company’s2003EquityIncentivePlan(EIP).

UndertheEIP,theCompanygrantedupto18.0

million shares of its Common Stock, plus any shares

available for future awards under the SIP, to the

Company’semployees,includingexecutiveocers

andindependentcontractors.eEIPpermittedthe

Company to grant equity awards in the form of stock

options, stock appreciation rights and restricted stock.

e exercise price of each stock option granted equaled

themarketpriceoftheCompany’sstockatthedate

of grant. e options generally vest over a three -year

periodandhaveamaximumtermof10years.isplan

wasterminatedonJune16,2011andreplacedwiththe

Company’sOmnibusIncentivePlan(OmnibusPlan).

eExecutiveOcerEquityIncentivePlan(EOEP)

wasavailableonlytotheChiefExecutiveOcerand

certain other executive officers. ese officers no longer

44 Dollar Tree, Inc.