Dollar Tree 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Employee Stock Purchase Plan

UndertheDollarTree,Inc.EmployeeStockPurchasePlan

(ESPP),theCompanyisauthorizedtoissueupto5,278,125

shares of Common Stock to eligible employees. Under the

termsoftheESPP,employeescanchoosetohaveupto

10%oftheirannualbaseearningswithheldtopurchasethe

Company’scommonstock.epurchasepriceofthestockis

85%ofthelowerofthepriceatthebeginningortheendof

thequarterlyoeringperiod.UndertheESPP,theCompany

hassold4,656,492sharesasofFebruary2,2013.

efairvalueoftheemployees’purchaserightsis

estimated on the date of grant using the Black-Scholes

option-pricing model with the following weighted

average assumptions:

Fiscal

2012

Fiscal

2011

Fiscal

2010

Expectedterm 3 months 3months 3months

Expectedvolatility 11.9% 12.6% 13.2%

Annual dividend yield — — —

Risk free interest rate 0.1% 0.1% 0.1%

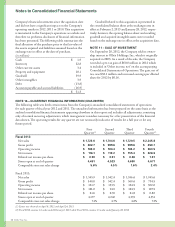

Stock Option Activity

February 2, 2013

Shares

Weighted

Average

Per Share

ExercisePrice

Weighted

Average

Remaining

Term

Aggregate

IntrinsicValue

(in millions)

Outstanding, beginning of period 1,311,106 $ 10.15

Granted 11,284 47.0 0

Exercised (574,585) 9.02

Forfeited (29,550) 9.29

Outstanding, end of period 718,255 $ 11.66 3.8 $ 20.4

Options vested and expected to vest

atFebruary2,2013 718,255 $ 11.66 3.8 $ 20.4

Options exercisable at end of period 718,255 $ 11.66 3.8 $ 20.4

Options Outstanding OptionsExercisable

RangeofExercisePrices

Options

Outstanding

atFebruary2,

2013

Weighted

Average

Remaining

Contractual Life

Weighted

Average

Exercise

Price

Options

Exercisable

atFebruary2,

2013

Weighted

Average

Exercise

Price

$5.38to$7.09 77,357 0.1 $ 6.67 77,357 $ 6.67

$7.10to$9.93 327,900 3.3 8.90 327,900 8.90

$9.94to$14.52 254,462 4.5 12.63 254,462 12.63

$14.53to$16.12 11,050 6.8 16.11 11,050 16.11

$16.13to$28.04 20,924 7.5 23.26 20,924 23.26

$28.05to$53.99 26,562 9.0 39.93 26,562 39.93

$5.38to$53.99 718,255 3.8 $ 11.66 718,255 $ 11.66

eintrinsicvalueofoptionsexercisedduring2012,2011and2010wasapproximately$21.8million,$16.4million

and$16.0million,respectively.

e weighted average per share fair value of purchase

rightsgrantedin2012,2011and2010was$6.97,$5.22

and$3.30,respectively.Totalexpenserecognizedfor

thesepurchaserightswas$0.9millionineachof2012,

2011and2010.

NOTE 10 – ACQUISITION

OnNovember15,2010,theCompanycompletedits

acquisitionof86DollarGiantstores,locatedinthe

Canadian provinces of British Columbia, Ontario,

AlbertaandSaskatchewan.esestoresoerawide

assortment of quality general merchandise, contemporary

seasonal goods and everyday consumables, all priced at

$1.25(CAD)orless.isistheCompany’srstexpan-

sion of its retail operations outside of the United States

and provides the Company with a proven management

team and distribution network as well as additional

potential store growth in a new market.

eCompanypaidapproximately$51.3million

including the assumption of certain liabilities. e results

of Dollar Giant store operations are included in the

2012AnnualReport47