Dollar Tree 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

stores to more consumer product merchandise which we

believe increases the traffic in our stores and has helped

to increase our sales even during the current economic

downturn.Whilethisshiftinmixhasimpactedour

merchandisecostswewereabletoosetthatimpactin

the current year with decreased costs for merchandise in

many of our categories.

Our point-of-sale technology provides us with valu-

able sales and inventory information to assist our buyers

and improve our merchandise allocation to our stores.

Webelievethatthishasenabledustobettermanageour

inventory flow resulting in more efficient distribution and

store operations and increased inventory turnover for

eachofthelastveyears.

Wemustcontinuetocontrolourmerchandisecosts,

inventory levels and our general and administrative

expenses as increases in these line items could negatively

impact our operating results.

Management’s Discussion & Analysis of

Financial Condition and Results of Operations

oftransactionsanda0.6%increaseinaverageticket.

Webelievecomparablestorenetsalescontinuedtobe

positivelyaectedbyanumberofourinitiatives,asdebit

and credit card penetration continued to increase in

2012,andwecontinuedtheroll-outoffrozenandrefrig-

erated merchandise to more of our stores. At February

2,2013wehadfrozenandrefrigeratedmerchandisein

approximately2,550storescomparedtoapproximately

2,220storesatJanuary28,2012.Webelievethatthe

additionoffrozenandrefrigeratedproductenablesusto

increase sales and earnings by increasing the number of

shopping trips made by our customers. In addition, we

acceptfoodstamps(undertheSupplementalNutrition

AssistanceProgram(“SNAP”))inapproximately4,200

qualiedstorescomparedto3,860attheendof2011.

Withthepressuresofthecurrenteconomic

environment, we have seen continued demand for basic,

consumableproductsin2012.Asaresult,wehave

continued to shift the mix of inventory carried in our

Results of Operations

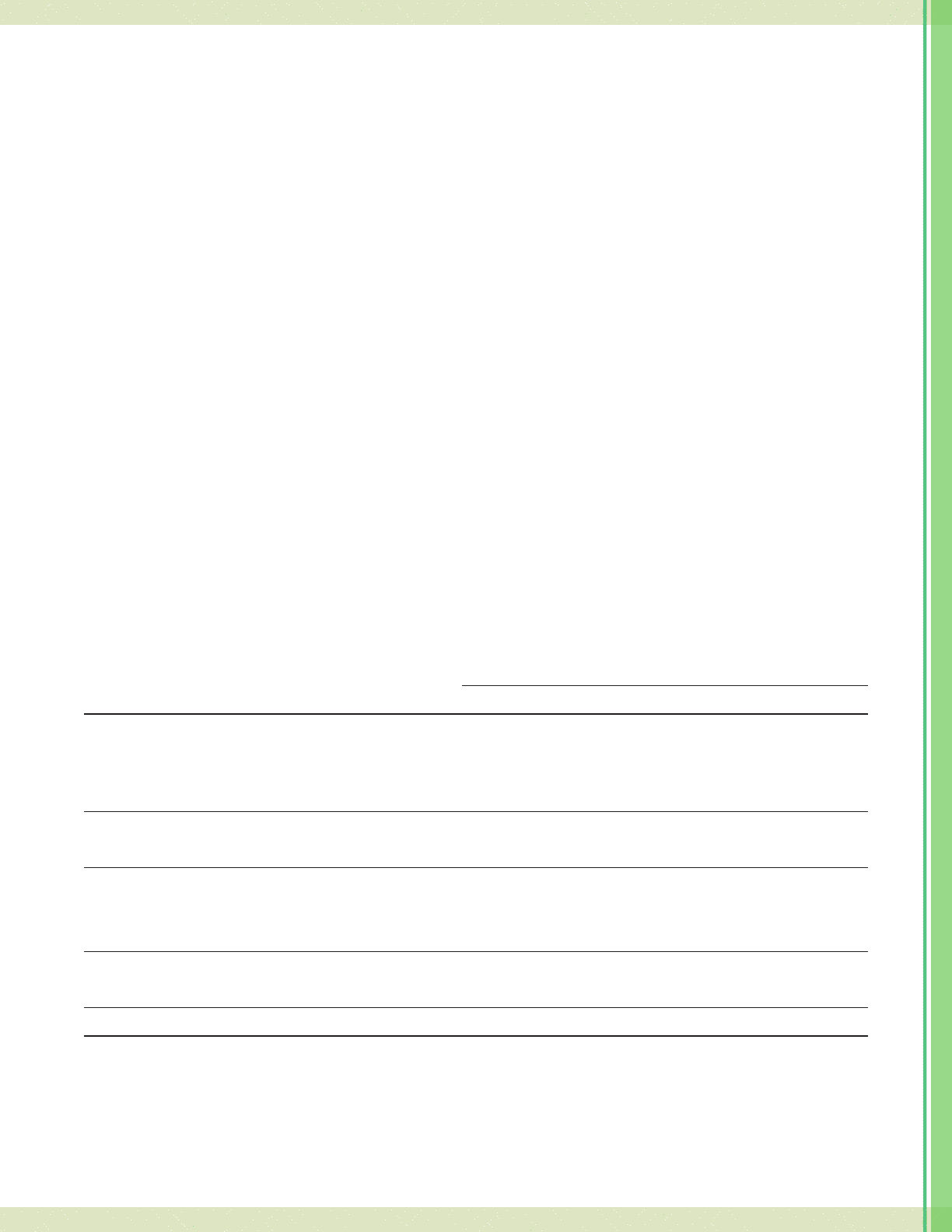

e following table expresses items from our consolidated statements of operations, as a percentage of net sales.

OnJanuary31,2010,therstdayofscal2010,webeganusingapproximately30inventorypoolsinourretail

inventory calculation, rather than one inventory pool as we had used since our inception. As a result of this change,

werecordedanon-recurring,non-cashchargetogrossprotandacorrespondingreductionininventory,atcost,

of$26.3millionintherstquarterof2010.

YearEnded

February 2, 2013 January28,2012 January29,2011

Netsales 100.0% 100.0% 100.0%

Cost of sales, excluding non-cash beginning

inventoryadjustment 64.1% 64.1% 64.1%

Non-cashbeginninginventoryadjustment — — 0.4%

Grossprot 35.9% 35.9% 35.5%

Selling, general and administrative expenses 23.5% 24.1% 24.8%

Operating income 12.4% 11.8% 10.7%

Interest expense, net — — (0.1%)

Other income, net (0.8%) — —

Income before income taxes 13.2% 11.8% 10.7%

Provision for income taxes (4.8%) (4.4%) (3.9%)

Netincome 8.4% 7.4% 6.8%

2012AnnualReport15