Dollar Tree 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis of

Financial Condition and Results of Operations

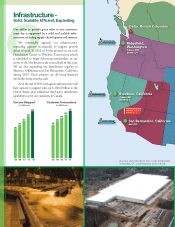

•OnNovember2,2009,wepurchasedanewdistribu-

tion center in San Bernardino, California. is new

distribution center replaced our Salt Lake City, Utah

leasedfacilitywhoseleaseendedinApril2010.

Overview

Our net sales are derived from the sale of merchandise.

Twomajorfactorstendtoaectournetsalestrends.

First is our success at opening new stores or adding new

stores through acquisitions. Second, sales vary at our

existingstoresfromoneyeartothenext.Werefertothis

change as a change in comparable store net sales, because

we compare only those stores that are open throughout

bothoftheperiodsbeingcompared.Weincludesales

from stores expanded during the year in the calculation

ofcomparablestorenetsales,whichhastheeectof

increasing our comparable store net sales. e term

‘expanded’alsoincludesstoresthatarerelocated.

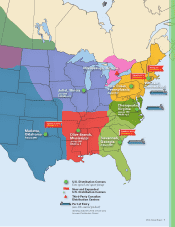

AtFebruary2,2013,weoperated4,671storesin

48statesandtheDistrictofColumbia,aswellasthe

Canadian provinces of British Columbia, Ontario,

Alberta,SaskatchewanandManitoba,with40.5million

sellingsquarefeetcomparedto4,351storeswith37.6

millionsellingsquarefeetatJanuary28,2012.During

scal2012,weopened345stores,expanded87storesand

closed25stores,comparedto278newstoresopened,91

storesexpandedand28storesclosedduringscal2011.

In the current year we increased our selling square footage

by7.7%.Ofthe345storesopenedinscal2012,25were

openedinJanuaryandvewereexpandedinJanuary

2013.Excludingthesestores,oursellingsquarefootage

increasedby7.1%.Ofthe2.9millionsellingsquarefoot

increasein2012,0.3millionwasaddedbyexpanding

existingstores.eaveragesizeofourstoresopenedin

2012wasapproximately8,060sellingsquarefeet(or

about9,900grosssquarefeet).For2013,wecontinueto

plantoopenstoresthatareapproximately8,000-10,000

sellingsquarefeet(orabout10,000-12,000grosssquare

feet).Webelievethatthisstoresizeisouroptimalsize

operationallyandthatthissizealsogivesourcustomers

an ideal shopping environment that invites them to shop

longer and buy more.

Fiscal2012endedonFebruary2,2013andincluded

53weeks,commensuratewiththeretailcalendar.e

53rdweekin2012addedapproximately$125million

insales.Fiscal2011andFiscal2010whichendedon

January28,2012,andJanuary29,2011,respectively,each

included52weeks.

Inscal2012,comparablestorenetsalesincreased

by3.4%.isincreasewasbasedonthecomparable

53weeksforbothyears.ecomparablestorenetsales

increasewastheresultofa2.8%increaseinthenumber

Key Events and Recent Developments

Several key events have had or are expected to have a

signicanteectonouroperations.Youshouldkeepin

mind that:

•InJuly2012,webeganconstructiononanew1.0

millionsquarefootdistributioncenterinWindsor,

Connecticut.Weexpecttobeginshippingproduct

fromthisbuildingin2013.

•OnJune6,2012,weenteredintoave-year

$750.0millionunsecuredCreditAgreement

(theAgreement).eAgreementprovidesfora

$750.0millionrevolvinglineofcredit,includingup

to$150.0millioninavailablelettersofcredit.e

interest rate on the facility is based, at our option,

on a LIBOR rate, plus a margin, or an alternate base

rate,plusamargin.OurFebruary2008,$550.0

million Credit Agreement was terminated concur-

rent with entering into this Agreement.

•OnOctober7,2011,ourBoardofDirectors

authorizedtherepurchaseofanadditional$1.5

billionofourcommonstock.AtFebruary2,2013,

wehad$859.8millionremainingunderBoard

authorizations.

•OnOctober7,2011,wecompleteda410,000

square foot expansion of our distribution center

in Savannah, Georgia. e Savannah distribution

centerisnowa1,014,000squarefoot,fullyauto-

mated facility.

•OnNovember15,2010,wecompletedour

acquisitionof86DollarGiantstores,locatedinthe

Canadian provinces of British Columbia, Ontario,

Alberta and Saskatchewan and we have since opened

storesinManitoba.esestoresoerawideassort-

ment of quality general merchandise, contemporary

seasonal goods and everyday consumables, all priced

at$1.25(CAD)orless.isisourrstexpansionof

retail operations outside of the United States.

•Weassigncosttostoreinventoriesusingtheretail

inventory method, determined on a weighted average

costbasis.Fromourinceptionandthroughscal

2009,weusedoneinventorypoolforthiscalcula-

tion. Because of our investments over the years in our

retailtechnologysystems,wewereabletoreneour

estimate of inventory cost under the retail method

andonJanuary31,2010,therstdayofscal2010,

webeganusingapproximately30inventorypools

in our retail inventory calculation. As a result of

this change, we recorded a non-recurring, non-cash

chargetogrossprotandacorrespondingreduction

ininventory,atcost,of$26.3millionintherst

quarterof2010.iswasaprospectivechangeand

didnothaveanyeectonpriorperiods.

14 Dollar Tree, Inc.