DHL 2009 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2009 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

e Commission appealed against the decision of the

Court of First Instance before the European Court of Justice.

Deutsche Post expects the appeal to o er only little prospect of

success. It cannot be ruled out, however, that the European Court

of Justice allows the appeal, with the Court of First Instance having

to decide the issue again. Despite the continuing litigation, the

ruling of the Commission could possibly become e ective again;

the total amount received as a result of the decision by the Court of

First Instance dated July , plus interest, would have to be paid

again to the Federal Republic of Germany.

In October Global Forwarding, along with all other

major players in the freight forwarding industry, received a request

for information from the Competition Directorate of the European

Commission, a subpoena from the United States Department of Jus-

tice’s Antitrust Division and information requests from competition

authorities in other jurisdictions in connection with a formal inves-

tigation into the setting of surcharges and fees in the international

freight forwarding industry. In January , an antitrust class ac-

tion law suit was initiated in the New York district court on behalf of

purchasers of freight forwarder services in which Deutsche Post

and are named as defendants. is civil law suit appears to be

based on the fact that anti-trust investigations are on-going, but not

on any known outcome or quanti ed loss.

Deutsche Post DHL is

not able to predict or comment on the outcome of the investigations

or the merits of the class action law suit, but believes its nancial

exposure in relation to both is limited and has not, therefore, taken

any provision in its accounts.

Share-based remuneration

Share-based remuneration for executives

(Share Matching Scheme)

A new system to grant variable remuneration components for

some of the Group’s executives was implemented in , which is

accounted for as an equity-settled share-based payment in accord-

ance with . According to this system, the Group’s executives

concerned receive part of their variable salary in the form of

shares of Deutsche Post in with each executive being able

to increase this obligatory share component individually by convert-

ing another portion of the variable remuneration. If certain

conditions are met, the executive will be awarded the same amount

of Deutsche Post shares a er four years (matching shares).

Hence, the programme for the tranche will expire in .

e fair value of these matching shares equals the stock price of

Deutsche Post as at the grant date .. For the grant of vari-

able remuneration portions, million were recognised in equity

in the consolidated nancial statements as at December . In

, this system will be applied to other Group executives as well.

Share-based remuneration system for executives

( Stock Option Plan)

e exercise period for the tranche of the Stock

Option Plan ended on June . Under the plan’s terms,

all options and stock appreciation rights or of this tranche not

exercised by June were forfeited. As such, no options or

have been outstanding under the Stock Option Plan since

July .

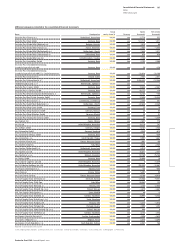

Stock Option Plan

Tranche 2004

Grant date 1 July 2004

Stock options granted 9,328,296

of which to Board of Management 841,350

of which to other senior executives 8,486,946

granted1) 1,116,374

of which to Board of Management 0

of which to other senior executives 1,116,374

Exercise price € 17.00

Lock-up expires 30 June 2007

Dividend yield Deutsche Post 3.05 %

Dividend yield Dow Jones Euro Index 1.7 %

Yield volatility of Deutsche Post share 28.9 %

Yield volatility of Dow Jones Euro Index 14.8 %

Number

Outstanding stock options as at January 2,726,658

Outstanding as at January 232,568

Stock options lapsed 2,726,658

lapsed 232,568

Stock options exercised 0

exercised 0

Outstanding stock options as at December 0

Outstanding as at December 0

Due to legal restrictions were granted instead of stock options in some countries. Due to the

fair value determined for the no amounts were added to the provisions in .

Deutsche Post DHL Annual Report

Consolidated Financial Statements

Notes

Other disclosures

189