DHL 2009 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2009 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

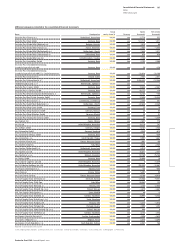

e net gains and losses from nancial instruments classi-

ed in accordance with the measurement categories of are

composed as follows:

Net gains and losses of the measurement categories

m

2008 2009

Loans and receivables 214 184

Held-to-maturity fi nancial assets 0 0

Financial assets and liabilities recognised at fair value

through profi t or loss

Trading –181 –146

Fair value option 18 –10

Other fi nancial liabilities –26 46

e net gains and losses mainly include the e ects of valua-

tion allowances, fair-value measurement, and disposals (disposal

gains / losses). Dividends and interest are not taken into account for

the nancial instruments recognised at fair value in pro t or loss.

Details of net gains or losses on the nancial assets available for sale

can be found in

Note

. Income and expense from interest and

commission agreements of the nancial instruments not measured

at fair value through pro t or loss are explained in the income state-

ment disclosures.

Cumulative costs for loans and receivables include write-

downs of trade receivables from Arcandor in the amount of

million.

Contingent liabilities

e Group’s contingent liabilities total , million (previ-

ous year: , million). million of the contingent liabilities re-

late to guarantee obligations (previous year: million), mil-

lion to warranties (previous year: million) and million

to liabilities from litigation risks (previous year: million). e

other contingent liabilities amounting to , million (previous

year: , million) mainly relate to obligations from formal state

aid proceedings, see also Note .

Other fi nancial obligations

In addition to provisions, liabilities, and contingent liabilities,

there are other nancial obligations amounting to , million

(previous year: , million) from non-cancellable operating

leases as de ned by .

e Group’s future non-cancellable payment obligations un-

der leases are attributable to the following asset classes:

Lease obligations

m

2008 2009

Land and buildings 6,452 5,359

Technical equipment and machinery 68 106

Other equipment, operating and o ce equipment 49 25

Transport equipment 501 376

Aircraft 194 312

Miscellaneous 10 15

Leases 7,274 6,193

e decrease in operating leases is due to the decline in the

express business (previous year: million). e increase in

the aircra item is mainly due to the eet expansion at AeroLogic

GmbH. In the previous year, million of the leasing obligations

related to the Deutsche Postbank Group.

Maturity structure of lease payments

m

2008 2009

Year after reporting date 1,452 1,357

Year after reporting date 1,174 1,023

Year after reporting date 994 800

Year after reporting date 717 600

Year after reporting date 533 478

Year after reporting date and thereafter 2,404 1,935

Maturity structure of minimum lease payments 7,274 6,193

e present value of discounted minimum lease payments is

, million (previous year: , million), based on a discount

factor of . (previous year: . ) Overall, rental and lease

payments of , million (previous year: , million) arose,

of which , million (previous year: , million) relate to

non-cancellable leases. , million (previous year: , mil-

lion) of the future lease obligations from non-cancellable leases re-

lates primarily to Deutsche Post Immobilien GmbH.

e purchase obligation for investments in non-current assets

amounted to million (previous year: million).

Deutsche Post DHL Annual Report

Consolidated Financial Statements

Notes

Other disclosures

187