Cincinnati Bell 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

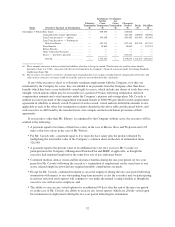

The Management Pension Plan is a tax-qualified defined benefit pension plan and is the same plan that is

available to all other eligible salaried and certain non-union hourly employees. Mr. Cassidy also participates in

the SERP. Contributions to the Management Pension Plan and the SERP are made only by the Company.

The Management Pension Plan is a cash balance plan. Under this plan, each participant has an account to

which pension credits are allocated at the end of each year based upon the participant’s attained age and plan

compensation for the year (with such plan compensation being subject to a maximum legal annual compensation

limit, which limit was $245,000 for 2009). A participant’s plan compensation for the year generally equals the

participant’s base salary plus any commissions or bonuses received. To the extent that a participant’s plan

compensation exceeds the aforementioned annual compensation limitation, additional pension credits are given

for such additional compensation under a non-tax-qualified retirement plan that is operated in conjunction with

the Management Pension Plan (the “Excess Benefit Plan”). Based on the changes to the Management Pension

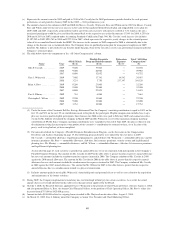

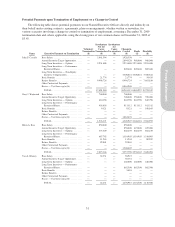

Plan in 2009, the following chart shows the annual pension credits provided at the ages indicated:

Attained Age Pension Credits *

50 but less than 55 years 6.50% of total plan compensation plus 6.50% of excess compensation for 2009

55 or more years 8.00% of total plan compensation plus 8.00% of excess compensation for 2009

* For purposes of the above table, “excess compensation” means the portion of a plan participant’s total plan

compensation for 2009 that exceeds the Social Security old-age retirement taxable wage base for 2009.

A participant’s account under the Management Pension Plan is also generally credited with assumed interest

for each calendar year at a certain interest rate. Such interest rate was 4.0% per annum for 2009 with respect to a

participant while still employed by the Company and 3.5% (or 4.0% if a participant elects out of a pre-retirement

death benefit) for a participant while not employed by the Company. In the case of a participant who was a

participant in the Management Pension Plan on December 31, 1993 or who has benefits transferred from other

plans to the Management Pension Plan, the participant’s account also was credited with pension credits

equivalent to the participant’s accrued benefit under the plan or such other plans on that date or when such

benefits are transferred, as the case may be.

After retirement or other termination of employment, a participant under the Management Pension Plan is

entitled to elect to receive a benefit under the plan in the form of a lump sum payment or as an annuity, generally

based on the balance credited to the participant’s cash balance account under the plan when the benefit begins to

be paid (but also subject to certain transition or special benefit formula rules in certain situations).

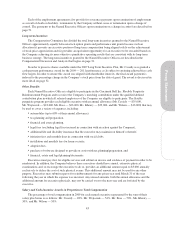

Under the SERP, each current active participant’s pension at retirement, if paid in the form of a single life

annuity, generally will be an amount equal to the difference between 50% of the participant’s average monthly

compensation (for the highest 36-month period of compensation that occurs during the 60-month period

preceding retirement) and the sum of the participant’s benefits payable under the Management Pension Plan

(including for this purpose amounts payable under the Excess Benefit Plan and any other amounts which are

intended to supplement or be in lieu of benefits under the Management Pension Plan) and Social Security

benefits. Also, there is a reduction in such pension amount of 2.5% for each year by which the sum of the

participant’s years of age and years of service at retirement total less than 75, and no benefits are payable if the

participant terminates employment (other than by reason of his or her death) prior to attaining age 55 and

completing at least 10 years of service credited for the purposes of the plan.

In addition, Mr. Cassidy’s employment agreement with the Company provides an additional retirement

benefit. Pursuant to such employment agreement, Mr. Cassidy is entitled to an additional non-qualified

retirement benefit equal to a portion of his accrued pension under the Management Pension Plan that is

attributable to his first ten years of service. This benefit shall be paid to Mr. Cassidy (or his estate if his

employment terminates by reason of his death) in a single lump sum within thirty days after the earlier of six

months after his termination date or the date of his death.

48