Cincinnati Bell 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

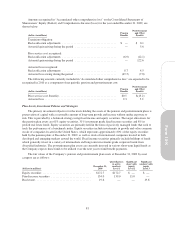

Capital Lease Obligations

The Company leases facilities and equipment used in its operations, some of which are required to be

capitalized in accordance with ASC 840, “Leases.” This guidance requires the capitalization of leases meeting

certain criteria, with the related asset being recorded in property, plant and equipment and an offsetting amount

recorded as a liability discounted to the present value. The Company had $125.1 million and $54.3 million in

total indebtedness relating to capitalized leases at December 31, 2009 and 2008, respectively, of which $111.7

million and $47.2 million was long-term debt. Recourse under a capital lease obligation is generally limited to

the underlying assets subject to the lease. For 2009, 2008, and 2007, the Company recorded $4.3 million, $3.1

million, and $2.0 million, respectively, of interest expense related to capital lease obligations.

In December 2009, the Company sold 196 wireless towers for $99.9 million in cash proceeds, and leased

back a portion of the space on these towers for a term of 20 years. The 196 towers sold were composed of 148

towers that were sold without purchase price contingencies, and 48 towers that were sold with purchase price

contingencies related to collection of net tower rents from other tenants for amounts represented by the Company

and on which the purchase price was based.

The leaseback of a portion of the space on the towers has been classified as a capital lease for the 148 towers

sold without purchase price contingencies and will be classified as a capital lease for the 48 towers sold that are

subject to purchase price contingencies once the contingencies are resolved. For the 148 wireless towers sold

without purchase price contingencies, the capital lease liability totaled $46.7 million at December 31, 2009. For

the 48 towers sold subject to purchase price contingencies, a capital lease asset and capital lease liability of

approximately $15 million will be recorded once the contingencies have been resolved.

In addition to the tower sale-leaseback, the Company also extended by 20 years the lease term of the space

on 53 other wireless towers that were previously recorded as operating leases. This extension of the lease term

resulted in new capital leases and the Consolidated Balance Sheet includes the related capital lease asset and

capital lease liability of $22.5 million as of December 31, 2009. See Note 5 for further discussion regarding the

sale of the wireless towers.

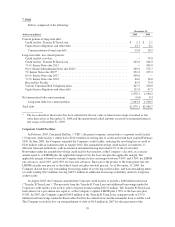

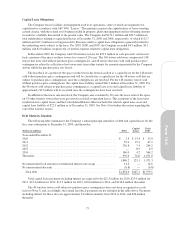

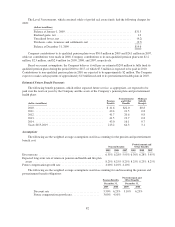

Debt Maturity Schedule

The following table summarizes the Company’s annual principal maturities of debt and capital leases for the

five years subsequent to December 31, 2009, and thereafter:

(dollars in millions) Debt

Capital

Leases

Total

Debt

Year ended December 31,

2010 ............................................................. $ 2.4 $ 13.4 $ 15.8

2011 ............................................................. 52.0 15.2 67.2

2012 ............................................................. 236.8 7.4 244.2

2013 ............................................................. — 8.9 8.9

2014 ............................................................. 560.0 4.2 564.2

Thereafter ......................................................... 995.0 76.0 1,071.0

1,846.2 125.1 1,971.3

Net unamortized call amounts on terminated interest rate swaps .............. 14.6 — 14.6

Net unamortized discount ............................................. (6.8) — (6.8)

Total debt ....................................................... $1,854.0 $125.1 $1,979.1

Total capital lease payments including interest are expected to be $22.3 million for 2010, $23.0 million for

2011, $14.3 million for 2012, $15.3 million for 2013, $10.0 million for 2014, and $130.6 million thereafter.

The 48 wireless towers sold subject to purchase price contingencies have not been recognized as a sale

(refer to Note 5) and, accordingly, the related leaseback payments are not included in the table above. Payments

including interest for these sites are approximately $1 million annually from 2010 to 2014, and $26 million

thereafter.

75

Form 10-K