Cincinnati Bell 2009 Annual Report Download - page 50

Download and view the complete annual report

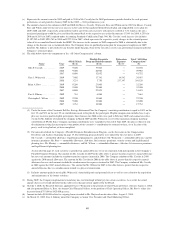

Please find page 50 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Bonus Target:

•Mr. Ross’s target bonus remains unchanged at 100% of base salary, which is 155% of the peer group

benchmark.

•Mr. Wojtaszek’s target bonus remains unchanged at 100% of base salary, which is 164% of the peer group

benchmark.

•Ms. Khoury’s target bonus remains unchanged at 60% of base salary, which is 151% of the peer group

benchmark.

•Mr. Wilson’s target bonus remains unchanged at 65% of base salary, which is 161% of the peer group

benchmark.

Long-Term Incentives:

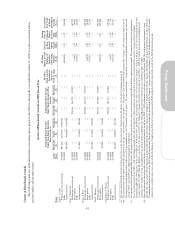

•For the 2009 fiscal year, Mr. Ross was granted 265,719 performance units (at target) with respect to the

2009 – 2011 performance period in January 2009, a nonqualified stock option for 362,162 common shares

in December 2008, and another nonqualified stock option for 60,938 common shares and 103,185 SARs

in January 2009. For the 2010 fiscal year, Mr. Ross was granted 34,364 performance units (at target) with

respect to the 2010 – 2012 performance period and a stock option for 69,846 common shares, both of

which were granted in January 2010. Mr. Ross’s total 2010 opportunity is equal to 38% of the peer group

benchmark.

•For the 2009 fiscal year, Mr. Wojtaszek was granted 264,728 performance units (at target) with respect to

the 2009 – 2011 performance period in January 2009, a nonqualified stock option for 324,324 common

shares in December 2008 and another nonqualified stock option for 76,989 common shares and 130,363

SARs in January 2009. For the 2010 fiscal year, Mr. Wojtaszek was granted 103,952 performance units

(at target) with respect to the 2010 – 2012 performance period and a stock option for 211,284 common

shares, both of which were granted in January 2010. Mr. Wojtaszek’s total 2010 opportunity is equal to

102% of the peer group benchmark.

•For the 2009 fiscal year, Ms. Khoury was granted 250,000 performance units (at target) with respect to the

2009 – 2011 performance period and a nonqualified stock option for 200,000 common shares upon hire in

March 2009. For the 2010 fiscal year, Ms. Khoury was granted 34,364 performance units (at target) with

respect to the 2010 – 2012 performance period and a stock option for 69,846 common shares, both of

which were granted in January 2010. Ms. Khoury’s total 2010 opportunity is equal to 163% of the peer

group benchmark.

•For the 2009 fiscal year, Mr. Wilson was granted 201,272 performance units (at target) with respect to the

2009 – 2011 performance period in January 2009, a nonqualified stock option for 210,810 common shares

in December 2008 and another nonqualified stock option for 74,495 common shares and 126,140 SARs in

January 2009. For the 2010 fiscal year, Mr. Wilson was granted 101,375 performance units (at target) with

respect to the 2010 – 2012 performance period and a stock option for 206,046 common shares, both of

which were granted in January 2010. Mr. Wilson’s total 2010 opportunity is equal to 102% of the peer

group benchmark.

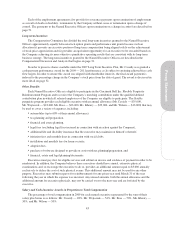

The Compensation Committee then met in executive session with only Mr. Mazza, an independent outside

consultant, to determine the amount of Mr. Cassidy’s compensation elements for 2010. Mr. Mazza presented the

market pay levels for each component of pay and responded to questions asked by the Compensation Committee.

The Compensation Committee, following discussions and deliberations, prepared and presented its

recommendations for approval by the full Board, which recommendations were approved.

36