Cincinnati Bell 2009 Annual Report Download - page 134

Download and view the complete annual report

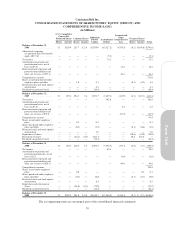

Please find page 134 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock-Based Compensation — The Company values all share-based payments to employees at fair value

on the date of grant and expenses this amount over the applicable vesting period. The fair value of stock options

and stock appreciation rights is determined using the Black-Scholes option-pricing model using assumptions

such as volatility, risk-free interest rate, holding period and dividends. The fair value of stock awards is based on

the Company’s closing share price on the date of grant. For all share-based payments, an assumption is also made

for the estimated forfeiture rate based on the historical behavior of employees. The forfeiture rate reduces the

total fair value of the awards to be recognized as compensation expense. The Company’s policy for graded

vesting awards is to recognize compensation expense on a straight-line basis over the vesting period. The

Company also has granted employee awards to be ultimately paid in cash which are indexed to the change in the

Company’s common stock price. These liability awards are marked to fair market value at each quarter-end, and

the adjusted fair value is expensed on a pro-rata basis over the vesting period. Refer to Note 13 for further

discussion related to stock-based and deferred compensation plans.

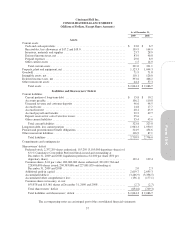

Employee Benefit Plans — As more fully described in Note 9, the Company maintains qualified and

non-qualified defined benefit pension plans, and also provides postretirement healthcare and life insurance

benefits for eligible employees. The Company recognizes the overfunded or underfunded status of its defined

benefit pension and other postretirement benefit plans as either an asset or liability in its Consolidated Balance

Sheets and recognizes changes in the funded status in the year in which the changes occur as a component of

comprehensive income. Pension and postretirement healthcare and life insurance benefits earned during the year

and interest on the projected benefit obligations are accrued and recognized currently in net periodic benefit cost.

Prior service costs and credits resulting from changes in management postretirement plan benefits are amortized

over the average life expectancy of the participants while management pension plan benefits and

non-management plan benefits are amortized over the average remaining service period of the employees

expected to receive the benefits. Net gains or losses resulting from differences between actuarial experience and

assumptions or from changes in actuarial assumptions are recognized as a component of annual net periodic

benefit cost. Unrecognized actuarial gains or losses that exceed 10% of the projected benefit obligation are

amortized on a straight-line basis over the average remaining service life of active employees (approximately 15

years).

Termination Benefits — The Company has written severance plans covering both its management and

union employees and, as such, accrues probable and estimable employee separation liabilities in accordance with

ASC 712. These liabilities are based on the Company’s historical experience of severance, historical costs

associated with severance, and management’s expectation of future severance.

The Company accrues for special termination benefits upon acceptance by an employee of any voluntary

termination offer and determines if the employee terminations give rise to a pension and postretirement

curtailment charge in accordance with ASC 715. The Company’s policy is that terminations in a calendar year

involving 10% or more of the plan future service years will result in a curtailment of the pension or

postretirement plan. See Note 3 for further discussion of the Company’s restructuring plans.

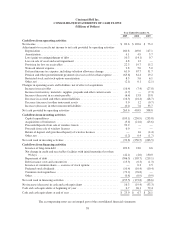

Derivative Financial Instruments — The Company is exposed to the impact of interest rate fluctuations on

its indebtedness. The Company periodically employs derivative financial instruments to manage its balance of

fixed rate and variable rate indebtedness. The Company does not hold or issue derivative financial instruments

for trading or speculative purposes. Interest rate swap agreements, a particular type of derivative financial

instrument, involve the exchange of fixed and variable rate interest payments and do not represent an actual

exchange of the notional amounts between the parties. At December 31, 2008, the Company had long-term

interest rate swaps that qualified as fair value hedges and were accounted for in accordance with ASC 815. Fair

value hedges offset changes in the fair value of underlying assets and liabilities. All of the long-term interest rate

swaps held at December 31, 2008 were terminated or called in 2009.

The realized gain or loss on a terminated interest rate swap contract that was designated as a fair value

hedge is amortized to “Interest expense” in the Consolidated Statements of Operations over the remaining term

of the underlying hedged item.

The Company also held short-term interest rate swap contracts as of December 31, 2008, which were not

designated as hedging instruments under ASC 815. As a result, the change in the fair value of these instruments

was recognized in net income during each period that these instruments were outstanding in “Other expense

(income), net” on the Consolidated Statement of Operations.

64