Cincinnati Bell 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company recognizes accrued penalties related to unrecognized tax benefits in income tax expense. The

Company recognizes accrued interest related to unrecognized tax benefits in interest expense. Accrued interest

and penalties are insignificant at December 31, 2009 and December 31, 2008.

13. Stock-Based and Deferred Compensation Plans

The Company generally grants performance-based awards, time-based restricted shares, and stock options.

Shares authorized and available for grant under these plans were 33.1 million and 8.0 million, respectively, at

December 31, 2009.

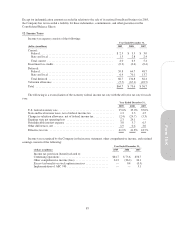

Performance-Based Restricted Awards

Awards granted generally vest over three to four years and upon the achievement of certain performance-

based objectives. Under ASC 718, “Compensation — Stock Compensation,” performance-based awards are

expensed based on their grant date fair value if it is probable that the performance conditions will be achieved.

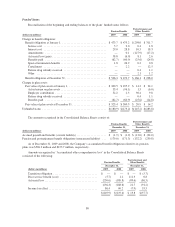

The following table provides a summary of the Company’s outstanding performance-based restricted shares:

2009 2008 2007

(in thousands) Shares

Weighted-

Average

Grant Date

Fair Value

Per Share Shares

Weighted-

Average

Grant Date

Fair Value

Per Share Shares

Weighted-

Average

Grant Date

Fair Value

Per Share

Non-vested as of January 1, ................ 2,307 $4.20 2,932 $4.75 1,668 $4.30

Granted* ............................... 2,786 2.95 1,438 3.98 1,896 5.01

Vested ................................. (838) 4.16 (550) 4.51 (444) 4.29

Forfeited ............................... (37) 2.99 (1,513) 4.95 (188) 4.52

Non-vested at December 31, ............... 4,218 $3.39 2,307 $4.20 2,932 $4.75

(dollars in millions)

Compensation expense for the year .......... $ 3.9 $ 3.1 $ 4.5

Tax benefit related to compensation expense . . $ (1.4) $ (1.2) $ (1.7)

Grant date fair value of shares vested ........ $ 3.5 $ 2.5 $ 1.9

* Assumes the maximum number of awards that can be earned if the performance conditions are achieved.

As of December 31, 2009, unrecognized compensation expense related to performance-based awards was

$1.8 million, which is expected to be recognized over a weighted average period of one year. In addition to the

shares granted above in 2009, the Company also granted a cash-payment performance award with a base award

of $1.3 million, with the final award payment indexed to the percentage change in the Company’s stock price

from the date of grant. The expense recorded for 2009 was $3.3 million, and there is no remaining unrecognized

compensation.

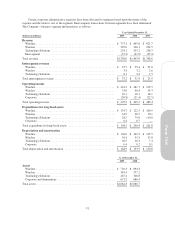

Time-Based Restricted Awards

The grant date fair value of time-based restricted shares generally vest and are expensed in one-third

increments over a period of three years. The following table provides a summary of the Company’s outstanding

time-based restricted shares:

2009 2008 2007

(in thousands) Shares

Weighted-

Average

Grant Date

Fair Value

Per Share Shares

Weighted-

Average

Grant Date

Fair Value

Per Share Shares

Weighted-

Average

Grant Date

Fair Value

Per Share

Non-vested as of January 1, ................... 303 $4.82 375 $4.87 253 $4.74

Granted ................................... 107 2.90 60 4.69 280 4.94

Vested .................................... (171) 4.82 (97) 4.85 (144) 4.78

Forfeited .................................. (26) 4.87 (35) 5.03 (14) 4.74

Non-vested at December 31, ................... 213 $3.85 303 $4.82 375 $4.87

(dollars in millions)

Compensation expense for the year ............. $ 0.9 $0.7 $ 0.7

Tax benefit related to compensation expense ...... $(0.3) $(0.3) $ (0.3)

Grant date fair value of shares vested ............ $ 0.8 $0.5 $ 0.7

87

Form 10-K