Cincinnati Bell 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

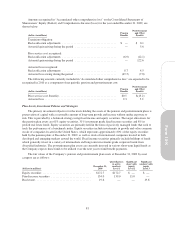

prior service cost and transition obligation of a benefit of $1.0 million and a cost of $1.2 million, respectively. In

the first quarter of 2008, as a result of the early retirement special termination benefits, the Company remeasured

its union pension and postretirement obligations using revised assumptions, including modified retiree benefit

payment assumptions and a discount rate of 6.4%. As a result of the remeasurement, the Company’s pension and

postretirement obligations were reduced by approximately $17 million, deferred tax assets were reduced for the

related tax effect by $6 million, and equity was increased by $11 million.

In 2007, the Company announced changes to its pension and postretirement plans that reduce medical

benefit payments by fixing the annual Company contribution for certain eligible retirees and that reduce life

insurance benefits paid from these plans. Based on these changes, the Company determined that a remeasurement

of its pension and postretirement obligations was necessary. The Company remeasured its pension and

postretirement obligations in 2007 using revised assumptions, including modified benefit payment assumptions

reflecting the changes and a discount rate of 6.25%. These changes reduced the Company’s pension and

postretirement obligations by approximately $74 million, reduced deferred tax assets for the related tax effect by

$27 million, and increased equity by $47 million.

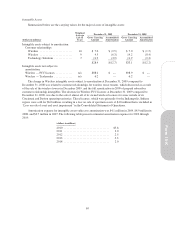

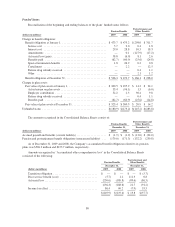

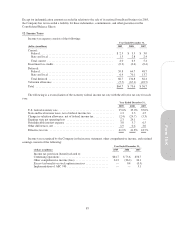

Components of Net Periodic Cost

The following information relates to all Company noncontributory defined benefit pension plans,

postretirement health care, and life insurance benefit plans. Approximately 10% in 2009 and 9% in 2008 and

2007 of these costs were capitalized to property, plant and equipment related to network construction in the

Wireline segment. Pension and postretirement benefit costs for these plans were comprised of:

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) 2009 2008 2007 2009 2008 2007

Service cost ....................................... $ 5.7 $ 9.0 $ 8.3 $ 0.4 $ 1.8 $ 3.4

Interest cost on projected benefit obligation .............. 29.0 28.8 28.0 10.3 18.3 20.1

Expected return on plan assets ......................... (26.0) (34.8) (34.6) (0.9) (1.9) (3.6)

Amortization of:

Transition obligation ..............................———0.12.04.1

Prior service cost (benefit) .......................... 0.7 0.4 2.2 (12.1) 0.4 5.4

Actuarial loss .................................... 8.7 2.8 3.6 4.5 3.5 3.7

Special termination benefit ........................... 1.8 26.2 8.1 0.3 0.8 0.1

Curtailment (gain) charge ............................ (7.6) 3.1 0.9 — 12.4 5.5

Benefit costs ....................................... $12.3 $ 35.5 $ 16.5 $ 2.6 $37.3 $38.7

79

Form 10-K