Cincinnati Bell 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

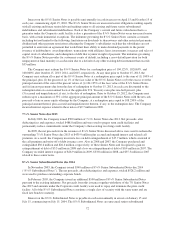

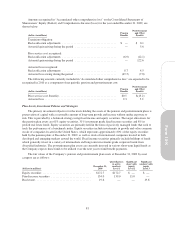

Amounts recognized in “Accumulated other comprehensive loss” on the Consolidated Statements of

Shareowners’ Equity (Deficit) and Comprehensive Income (Loss) for the year ended December 31, 2009, are

shown below:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Transition obligation:

Reclassification adjustments ...................................... $ — $ 0.1

Actuarial gain arising during the period ............................. — 5.6

Prior service cost recognized:

Reclassification adjustments ...................................... (6.9) (12.1)

Actuarial gain arising during the period ............................. — 122.6

Actuarial loss recognized:

Reclassification adjustments ...................................... 8.7 4.5

Actuarial loss arising during the period .............................. (49.5) (7.8)

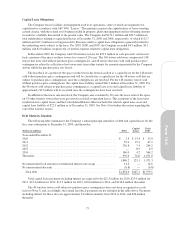

The following amounts currently included in “Accumulated other comprehensive loss” are expected to be

recognized in 2010 as a component of net periodic pension and postretirement cost:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Prior service cost (benefit) ........................................ $0.5 $(13.2)

Actuarial loss .................................................. 9.3 5.2

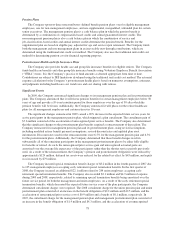

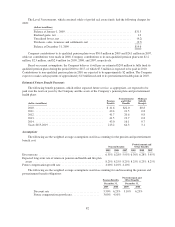

Plan Assets, Investment Policies and Strategies

The primary investment objective for the trusts holding the assets of the pension and postretirement plans is

preservation of capital with a reasonable amount of long-term growth and income without undue exposure to

risk. This is provided by a balanced strategy using fixed income and equity securities. The target allocations for

the pension plan assets are 61% equity securities, 31% investment grade fixed income securities and 8% in

pooled real estate funds. Equity securities are primarily held in the form of passively managed funds that seek to

track the performance of a benchmark index. Equity securities include investments in growth and value common

stocks of companies located in the United States, which represents approximately 80% of the equity securities

held by the pension plans at December 31, 2009, as well as stock of international companies located in both

developed and emerging markets around the world. Fixed income securities primarily include holdings of funds

which generally invest in a variety of intermediate and long-term investments grade corporate bonds from

diversified industries. The postretirement plan assets are currently invested in various short-term liquid funds as

the Company expects these funds to be utilized over the next year to fund benefit payments.

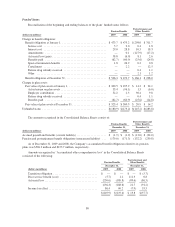

The fair values of the Company’s pension and postretirement plan assets at December 31, 2009 by asset

category are as follows:

(dollars in millions)

December 31,

2009

Quoted prices

in active

markets

Level 1

Significant

observable

inputs

Level 2

Significant

unobservable

inputs

Level 3

Equity securities .................................. $172.7 $172.7 $ — $ —

Fixed income securities ............................ 154.0 139.0 15.0 —

Real estate ....................................... 19.6 — — 19.6

81

Form 10-K