Cincinnati Bell 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

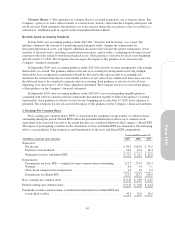

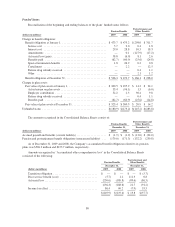

Tranche B Term Loan. The December 31, 2009 balance on the Tranche B Term Loan of $204.9 million matures

in quarterly payments of $0.5 million through September 30, 2011, and then in four quarterly installments of

$50.4 million ending on August 31, 2012.

Voluntary prepayments of the Corporate credit facility and voluntary reductions of the unutilized portion of

the revolving line of credit are permitted at any time at no cost to the Company. The average interest rate charged

on borrowings under the Corporate credit facility was 2.7%, 5.0%, and 6.9% in 2009, 2008, and 2007,

respectively. The Company recorded interest expense of $7.3 million, $14.6 million, and $18.8 million in 2009,

2008, and 2007, respectively.

The Company pays commitment fees for the unused amount of borrowings on the revolving credit facility

and letter of credit fees on outstanding letters of credit at an annual rate ranging from 0.50% to 0.75% and 3.00%

and 3.50%, respectively, based on certain Company financial ratios. These fees were $1.4 million in both 2009

and 2008 and $1.3 million in 2007.

The Company and all its future or existing subsidiaries (other than CBT, CBET, Cincinnati Bell Funding

LLC (“CBF”), its foreign subsidiaries and certain immaterial subsidiaries) guarantee borrowings of CBI under

the Corporate credit facility. Each of the Company’s current subsidiaries that is a guarantor of the Corporate

credit facility is also a guarantor of the 7% Senior Notes due 2015, 8

1

⁄

4

% Senior Notes due 2017, and 8

3

⁄

8

%

Senior Subordinated Notes due 2014, with certain immaterial exceptions. Refer to Notes 16 and 17 for

supplemental guarantor information. The Company’s obligations under the Corporate credit facility are also

collateralized by perfected first priority pledges and security interests in the following:

•substantially all of the equity interests of the Company’s U.S. subsidiaries (other than subsidiaries of CBT,

CBF, and certain immaterial subsidiaries) and 66% of its equity interests in its foreign subsidiaries; and

•certain personal property and intellectual property of the Company and its subsidiaries (other than that of

CBT, CBET, CBF, its foreign subsidiaries and certain immaterial subsidiaries) with a total carrying value

of approximately $400 million at December 31, 2009.

The Corporate credit facility financial covenants require that the Company maintain certain leverage,

interest coverage and fixed charge ratios. The Corporate credit facility also contains certain covenants which,

among other things, restrict the Company’s ability to incur additional debt or liens, pay dividends, repurchase

Company common stock, sell, transfer, lease, or dispose of assets and make investments or merge with another

company. If the Company were to violate any of its covenants and was unable to obtain a waiver, it would be

considered a default. If the Company were in default under the Corporate credit facility, no additional borrowings

under this facility would be available until the default was waived or cured. The Corporate credit facility

provides for customary events of default, including a cross-default provision for failure to make any payment

when due or permitted acceleration due to a default, both in respect to any other existing debt instrument having

an aggregate principal amount that exceeds $35 million. The Company believes it is in compliance with its

Corporate credit facility covenants.

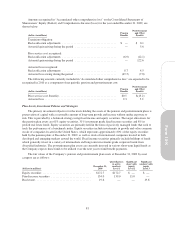

Various issuances of the Company’s public debt, which include the 8

1

⁄

4

% Senior Notes due 2017, the 8

3

⁄

8

%

Senior Subordinated Notes due 2014, and the 7% Senior Notes due 2015, are governed by indentures which

contain covenants that, among other things, limit the Company’s ability to incur additional debt or liens, pay

dividends or make other restricted payments, sell, transfer, lease, or dispose of assets and make investments or

merge with another company. Restricted payments include common stock dividends, repurchase of common

stock, and certain public debt repayments. The Company believes it has sufficient ability under its public debt

indentures to make its intended restricted payments in 2010. The Company believes it is in compliance with its

public debt indentures as of the date of this filing.

8

1

⁄

4

% Senior Notes due 2017

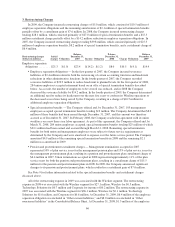

In October 2009, the Company issued $500 million of 8

1

⁄

4

% Senior Notes due 2017 (“8

1

⁄

4

% Senior Notes”).

Net proceeds of $492.8 million after debt discount were used to redeem the outstanding 7

1

⁄

4

% Senior Notes due

2013 of $439.9 million plus accrued and unpaid interest, related call premium, and for general corporate

purposes, including the repayment of other debt. The 8

1

⁄

4

% Senior Notes are fixed rate bonds to maturity.

71

Form 10-K