Cincinnati Bell 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

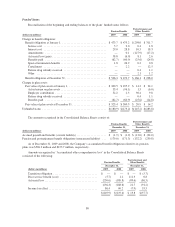

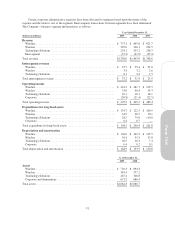

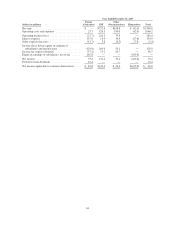

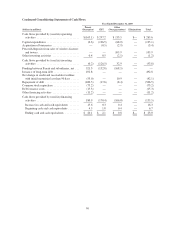

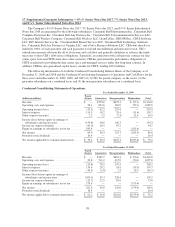

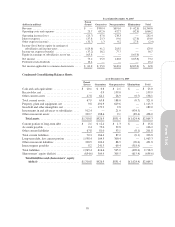

14. Business Segment Information

The Company operates in three segments: Wireline, Wireless, and Technology Solutions, as described

below. The Company’s segments are strategic business units that offer distinct products and services and are

aligned with its internal management structure and reporting.

The Wireline segment provides local voice, data, long distance, VoIP, and other services. Local voice

services include local telephone service, switched access, information services such as directory assistance, and

value-added services such as caller identification, voicemail, call waiting, call return and text messaging. Data

services include DSL and dial-up internet access, dedicated network access, and Gig-E-ATM based data

transport. Long distance and VoIP services include long distance voice, audio conferencing, VoIP and other

broadband services including private line and multi-protocol label switching. Other services mainly consist of

security monitoring services, public payphones, television over coaxial and fiber optical cable in limited areas,

high-speed internet over fiber optical cable in limited areas, DirecTV©commissioning over the Company’s entire

operating area, inside wire installation for business enterprises, data collocation services, and billing,

clearinghouse and other ancillary services primarily for inter-exchange (long distance) carriers. These services

are primarily provided to customers in southwestern Ohio, northern Kentucky, and southeastern Indiana. In

February 2008, eGIX, a CLEC provider of voice and long distance services primarily to business customers in

Indiana and Illinois, was purchased for $18.1 million. Wireline operating income includes restructuring charges

of $5.0 million in 2009, $27.1 million in 2008, and $36.1 million in 2007, as described in Note 3. Wireline

operating income in 2008 also includes an operating tax settlement gain of $10.2 million and an asset impairment

charge of $1.2 million.

The Wireless segment provides advanced digital wireless voice and data communications services and sales

of related handset equipment to customers in the Greater Cincinnati and Dayton, Ohio operating areas. In 2009,

the Company sold 196 towers for $99.9 million of cash proceeds. Refer to Note 5 for further discussion regarding

the sale of the wireless towers. Also in 2009, the Wireless segment sold almost all of its owned wireless licenses

for areas outside of its Cincinnati and Dayton operating territories. These licenses, which were primarily for the

Indianapolis, Indiana region, were sold for $6.0 million, resulting in a loss on sale of the spectrum asset of $4.8

million. The loss on sale is included in “Loss on sale of asset and asset impairment” in the Consolidated

Statement of Operations.

Technology Solutions provides a range of fully managed and outsourced IT and telecommunications

services and offers solutions that combine data center collocation services along with the sale, installation, and

maintenance of major branded IT and telephony equipment. On December 31, 2007, GramTel, which provides

data center services to small and medium-size companies and is based in South Bend, Indiana, was purchased for

$20.3 million.

Corporate operating income for 2008 includes costs associated with the settlement of a patent lawsuit

totaling $2.0 million.

90