Cincinnati Bell 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

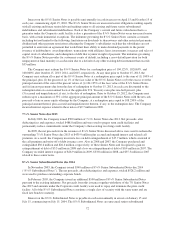

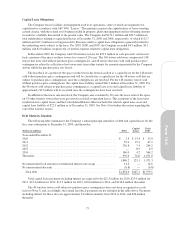

Deferred Financing Costs

Deferred financing costs are costs incurred in connection with obtaining long-term financing. These costs

are amortized on a straight-line basis as interest expense over the terms of the related debt agreements. As of

December 31, 2009 and 2008, deferred financing costs totaled $24.3 million and $22.5 million, respectively. The

related amortization, included in “Interest expense” in the Consolidated Statements of Operations, totaled $6.0

million in 2009, $5.1 million in 2008, and $5.2 million in 2007. In 2009, the Company incurred $15.3 million of

debt issuance costs related to the issuance of 8

1

⁄

4

% Senior Notes and the amendment of the corporate credit

facility. In 2009, the Company wrote-off $7.5 million of deferred financing costs related to the redemption of the

7

1

⁄

4

% Senior Notes due 2013, the amendment of the Corporate credit facility and the purchase and

extinguishment of a portion of the Cincinnati Bell Telephone notes. In 2008, the Company wrote-off deferred

financing costs of $1.6 million related to the purchase and extinguishment of the 7

1

⁄

4

% Senior Notes due 2013,

8

3

⁄

8

% Subordinated Notes, and 7% Senior Notes, and in 2007, the Company wrote-off deferred financing costs

of $1.2 million related to the repayment of the Tranche B Term loan and the purchase and retirement of the 7

1

⁄

4

%

Senior Notes due 2013 and the 8

3

⁄

8

% Subordinated Notes. The write-offs of deferred financing costs were

included in the Consolidated Statements of Operations under the caption “Loss (gain) on extinguishment of

debt.”

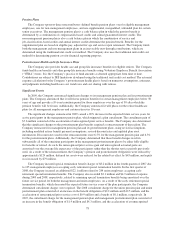

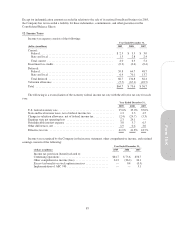

8. Financial Instruments and Fair Value

ASC 820 establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair

value of financial instruments as follows:

Level 1 – Observable inputs for identical instruments such as quoted market prices;

Level 2 – Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices

for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices

that are observable for the asset or liability (i.e., interest rates, yield curves, etc.), and inputs that are

derived principally from or corroborated by observable market data by correlation or other means

(market corroborated inputs); and

Level 3 – Unobservable inputs that reflect the Company’s determination of assumptions that market

participants would use in pricing the asset or liability. These inputs are developed based on the best

information available, including the Company’s own data.

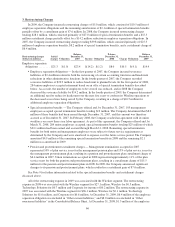

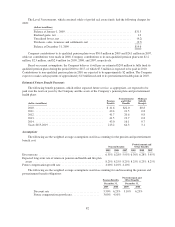

At December 31, 2009, the Company’s financial instruments that are required to be measured at fair value

were inconsequential. At December 31, 2008, the fair value of the Company’s financial instruments that are

required to be measured at fair value on a recurring basis were as follows:

(dollars in millions)

December 31,

2008 Level 1 Level 2 Level 3

Interest rate swap assets ........................... $22.6 $ — $22.6 $—

Interest rate swap liabilities ........................ 3.8 — 3.8 —

Money market funds .............................. 3.1 3.1 — —

The Company is exposed to the impact of interest rate fluctuations on its indebtedness. The Company

attempts to maintain an optimal balance of fixed rate and variable rate indebtedness in order to attain low overall

borrowing costs while mitigating exposure to interest rate fluctuations. The Company periodically employs

derivative financial instruments to manage its balance of fixed rate and variable rate indebtedness. The Company

does not hold or issue derivative financial instruments for trading or speculative purposes.

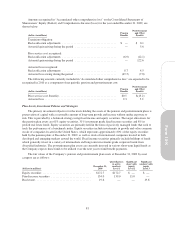

In 2004 and 2005, the Company entered into a series of fixed-to-variable long-term interest rate swaps with

total notional amounts of $450 million that qualified for fair value hedge accounting (“long-term interest rate

swaps”). Fair value hedges offset changes in the fair value of underlying assets and liabilities. In December 2008

and January 2009, certain counterparties exercised their right to call $250 million of the notional amount of long-

term interest rate swaps for the 8

3

⁄

8

% Subordinated Notes, for which the Company received $10.5 million in the

first quarter of 2009 upon termination of the swaps. In the third quarter of 2009, the Company terminated the

remaining long-term interest rate swaps and received $6.5 million. These amounts received are being amortized

as a reduction to interest expense over the terms of the 8

3

⁄

8

% Subordinated Notes and 7% Senior Notes.

76