Cincinnati Bell 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

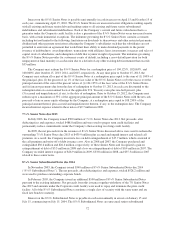

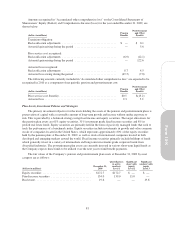

The Level 3 investments, which consisted solely of pooled real estate funds, had the following changes for

2009:

(dollars in millions)

Balance at January 1, 2009 .............................................. $31.3

Realized gains, net .................................................... 1.2

Unrealized losses, net .................................................. (9.2)

Purchases, sales, issuances and settlements, net ............................. (3.7)

Balance at December 31, 2009 ........................................... $19.6

Company contributions to its qualified pension plans were $50.0 million in 2009 and $24.1 million in 2007,

while no contributions were made in 2008. Company contributions to its non-qualified pension plan were $2.2

million, $2.3 million, and $2.4 million for 2009, 2008, and 2007, respectively.

Based on current assumptions, the Company believes it will pay an estimated $203 million to fully fund its

qualified pension plans during the period 2010 to 2017, of which $7.5 million is expected to be paid in 2010.

Contributions to non-qualified pension plans in 2010 are expected to be approximately $2 million. The Company

expects to make cash payments of approximately $13 million related to its postretirement health plans in 2010.

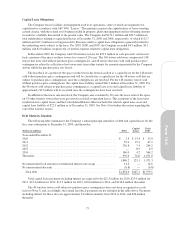

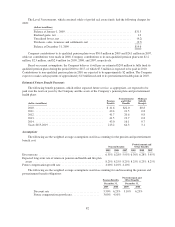

Estimated Future Benefit Payments

The following benefit payments, which reflect expected future service, as appropriate, are expected to be

paid over the next ten years by the Company and the assets of the Company’s pension plans and postretirement

health plans:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Medicare

Subsidy

Receipts

2010 ................................................ $ 41.6 $22.0 $0.8

2011 ................................................ 42.4 21.5 0.8

2012 ................................................ 41.7 20.6 0.8

2013 ................................................ 41.5 19.7 0.8

2014 ................................................ 43.0 16.1 0.7

Years 2015-2019 ...................................... 213.2 64.3 3.1

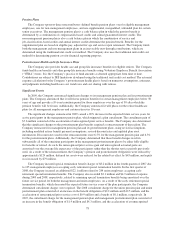

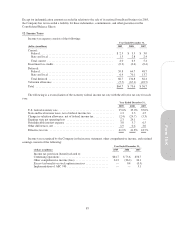

Assumptions

The following are the weighted average assumptions used in accounting for the pension and postretirement

benefit cost:

Pension Benefits

Postretirement and

Other Benefits

2009 2008 2007 2009 2008 2007

Discount rate ............................................. 6.35% 6.28% 5.95% 6.30% 6.28% 5.95%

Expected long-term rate of return on pension and health and life plan

assets ................................................. 8.25% 8.25% 8.25% 8.25% 8.25% 8.25%

Future compensation growth rate ............................. 4.00% 4.10% 4.10%

The following are the weighted average assumptions used in accounting for and measuring the pension and

postretirement benefit obligations:

Pension Benefits

Postretirement and

Other Benefits

December 31, December 31,

2009 2008 2009 2008

Discount rate .................................. 5.50% 6.25% 5.10% 6.25%

Future compensation growth rate ................... 3.00% 4.10%

82