Cincinnati Bell 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

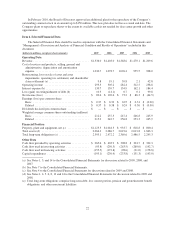

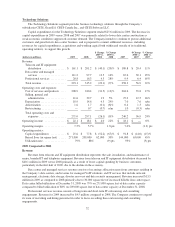

Costs and Expenses

Cost of services and products consists largely of network operation costs, interconnection expenses with

other telecommunications providers, roaming expense (which is incurred for subscribers to use their handsets in

the territories of other wireless service providers), and cost of handsets and accessories sold. These expenses

decreased $1.0 million during 2009 versus the prior year period. The decrease was primarily attributable to lower

operating taxes of $2.8 million and a $1.3 million decrease in third party service provider costs. These decreases

were offset by a $3.4 million increase in handset costs, primarily due to increased Company handset subsidies to

attract new smartphone customers.

Selling, general and administrative expenses decreased $2.5 million for 2009 compared to 2008, primarily

due to lower distributor commissions of $2.2 million resulting from lower activations, as well as lower

advertising and other costs partially offset by an increase in bad debt expense of $0.9 million.

The increase in depreciation expense of $4.5 million is related to the 3G wireless network that was launched

in late 2008.

The decrease in amortization expense from the prior year is due to the Company’s accelerated amortization

methodology.

During 2009, the Company sold almost all of its owned wireless licenses for areas outside of its Cincinnati

and Dayton operating territories. These licenses, which were primarily for the Indianapolis, Indiana region, were

sold for $6.0 million, resulting in a loss on sale of the spectrum assets of $4.8 million.

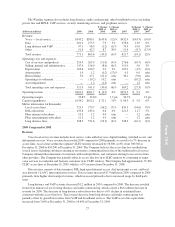

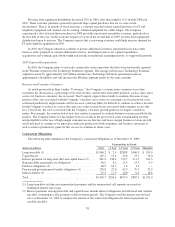

2008 Compared to 2007

Revenue

Service revenue increased by $23.0 million during 2008 as compared to 2007 primarily due to the

following:

•Postpaid service revenue increased $20.3 million due to an increase in average subscribers and ARPU.

Postpaid subscribers increased from 400,400 subscribers at December 31, 2007 to 403,700 at

December 31, 2008. The average monthly churn increased to 2.1% for 2008 compared to 1.6% for 2007.

The increase in churn resulted from increased competition and Company-initiated disconnections of

customers with credit problems. ARPU increased from $46.55 in 2007 to $48.69 in 2008. The ARPU

increase includes a 29% increase in data ARPU; and

•Prepaid service revenue increased $2.7 million compared to 2007 primarily due to an increase in ARPU of

$2.59 partially offset by a lower number of subscribers. The number of prepaid subscribers at

December 31, 2008 was 146,900, down from 170,600 prepaid subscribers at December 31, 2007. The

Company focused its marketing in 2008 on higher usage rate plans, which generated higher ARPU but led

to the decrease in the number of prepaid subscribers.

Equipment revenue decreased slightly from $27.0 million in 2007 to $25.6 million in 2008 primarily due to

lower handset revenue per unit and lower prepaid subscriber activations.

Costs and Expenses

Cost of services and products increased $10.5 million during 2008 versus 2007. The increase was primarily

attributable to a $9.7 million increase in network costs due to increased usage per subscriber and a $1.9 million

increase in handset and subsidy costs, primarily due to Company initiatives to attract new customers and to retain

existing customers. These increases were partially offset by lower operating taxes.

Selling, general and administrative expenses increased $2.5 million for 2008 compared to 2007, primarily

due to an increase in bad debt expense.

The decrease in amortization expense from 2007 is due to the Company’s accelerated amortization

methodology.

31

Form 10-K