Cincinnati Bell 2009 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

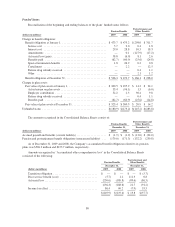

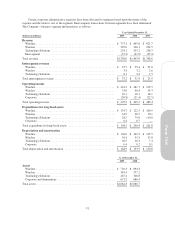

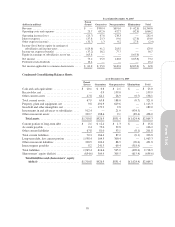

The following table summarizes the Company’s outstanding and exercisable awards at December 31, 2009

(shares in thousands):

Outstanding Exercisable

Range of Exercise Prices Shares

Weighted-Average

Exercise Prices

Per Share Shares

Weighted-Average

Exercise Prices

Per Share

$1.30 to $3.48 ................................... 6,113 $ 2.10 2,371 $ 2.92

$3.49 to $4.00 ................................... 3,841 3.83 3,015 3.83

$4.06 to $5.66 ................................... 5,732 5.28 5,378 5.31

$5.68 to $29.09 .................................. 3,783 16.24 3,783 16.24

$29.21 to $37.19 ................................. 703 35.62 703 35.62

Total ........................................ 20,172 $ 7.15 15,250 $ 8.76

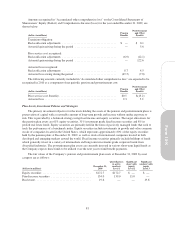

As of December 31, 2009, the aggregate intrinsic value for awards outstanding was approximately $8.2

million and for exercisable awards was $1.3 million. The weighted-average remaining contractual life for awards

outstanding and exercisable is approximately five years and four years, respectively. As of December 31, 2009,

there was $1.4 million of unrecognized stock compensation expense, which is expected to be recognized over a

weighted-average period of approximately two years.

The fair values at the date of grant were estimated using the Black-Scholes option-pricing model with the

following weighted-average assumptions:

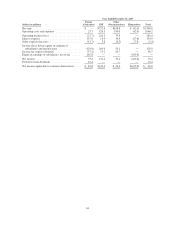

2009 2008 2007

Expected volatility ............................................. 41.7% 34.7% 29.6%

Risk-free interest rate ........................................... 2.1% 2.0% 3.6%

Expected holding period — years .................................555

Expected dividends ............................................ 0.0% 0.0% 0.0%

Weighted-average grant date fair value ............................. $1.45 $0.74 $1.61

The expected volatility assumption used in the Black-Scholes pricing model was based on historical

volatility. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant. The

expected holding period was estimated using the historical exercise behavior of employees and adjusted for

abnormal activity. Expected dividends are based on the Company’s history of not paying dividends.

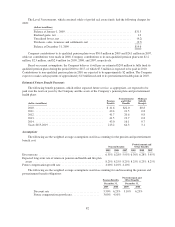

Deferred Compensation Plans

The Company currently has deferred compensation plans for both the Board of Directors and certain

executives of the Company. Under the directors deferred compensation plan, each director can defer receipt of all

or a part of their director fees and annual retainers, which can be invested in various investment funds including

the Company’s common stock. In addition, the Company annually grants 6,000 phantom shares to each

non-employee director on the first business day of each year, which are fully vested once a director has five years

of service. Distributions to the directors are generally in the form of cash. The executive deferred compensation

plan allows for certain executives to defer a portion of their annual base pay, bonus, or stock awards. Under the

executive deferred compensation plan, participants can elect to receive distributions in the form of either cash or

common shares. At December 31, 2009 and 2008, there were 0.9 million and 0.8 million common shares

deferred in these plans. As these awards can be settled in cash, the Company records compensation costs each

period based on the change in the Company’s stock price. The Company recognized compensation expense of

$1.4 million in 2009, income of $2.0 million in 2008 and expense of $0.3 million in 2007.

89

Form 10-K