Cigna 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 77

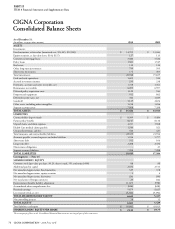

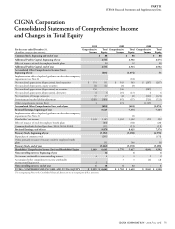

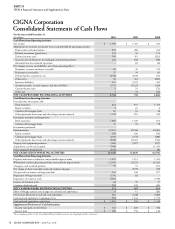

PART II

ITEM 8 Financial Statements and Supplementary Data

Notes to the Consolidated Financial Statements

NOTE 1 Description of Business

As used in this document, “CIGNA” and the “Company” may

refer to CIGNA Corporation itself, one or more of its subsidiaries,

or CIGNA Corporation and its consolidated subsidiaries. CIGNA

Corporation is a holding company and is not an insurance company.

Its subsidiaries conduct various businesses, which are described

in this Annual Report on Form 10-K for the fi scal year ended

December 31, 2010 (“Form 10-K”).

e Company is a global health service organization with subsidiaries

that are major providers of medical, dental, disability, life and

accident insurance and related products and services. In the U.S., the

majority of these products and services are off ered through employers

and other groups (e.g. unions and associations) and in selected

international markets, the Company off ers supplemental health, life

and accident insurance products, expatriate benefi ts and international

health care coverage and services to businesses, governmental and

non-governmental organizations and individuals. In addition to its

ongoing operations described above, the Company also has certain

run-off operations, including a Run-off Reinsurance segment.

NOTE 2 Summary of Signifi cant Accounting Policies

A. Basis of Presentation

e Consolidated Financial Statements include the accounts of

CIGNA Corporation and its signifi cant subsidiaries. Intercompany

transactions and accounts have been eliminated in consolidation.

ese Consolidated Financial Statements were prepared in conformity

with accounting principles generally accepted in the United States

of America (“GAAP”). Amounts recorded in the Consolidated

Financial Statements necessarily refl ect management’s estimates and

assumptions about medical costs, investment valuation, interest rates

and other factors. Signifi cant estimates are discussed throughout

these Notes; however, actual results could diff er from those estimates.

e impact of a change in estimate is generally included in earnings

in the period of adjustment.

In preparing these Consolidated Financial Statements, the Company

has evaluated events that occurred between the balance sheet date

and February 25, 2011 and determined there were no other items

to disclose.

Certain reclassifi cations have been made to prior period amounts to

conform to the current presentation. In addition, certain amounts

have been restated as a result of the adoption of new accounting

pronouncements.

Variable interest entities

As of December 31, 2010 and 2009 the Company determined it was

not a primary benefi ciary in any variable interest entities.

B. Recent Accounting Pronouncements

Deferred acquisition costs

In October 2010, the Financial Accounting Standards Board

(“FASB”) amended guidance (ASU 2010-26) for the accounting

of costs related to the acquisition or renewal of insurance contracts

to require costs such as certain sales compensation or telemarketing

costs that are related to unsuccessful eff orts and any indirect costs to

be expensed as incurred. is new guidance must be implemented

on January 1, 2012 or may be implemented earlier and any changes

to the Company’s Consolidated Financial Statements may be

recognized prospectively for acquisition costs incurred beginning

in 2012 or through retrospective adjustment of comparative prior

periods. e Company’s deferred acquisition costs arise from sales

and renewal activities primarily in its International segment and, to

a lesser extent, the Health Care and corporate-owned life insurance

businesses. Because the new requirements further restrict the types of

costs that are deferrable, the Company expects more of its acquisition

costs to be expensed when incurred under the new guidance. e

Company continues to evaluate these new requirements to determine

the timing, method and estimated eff ects of their implementation.

Credit quality disclosures

Eff ective December 31, 2010, the Company adopted the FASB’s

updated guidance (ASU 2010-20) that requires disclosures about the

credit quality and risks inherent in fi nancing receivables, including

how credit risk is analyzed and assessed on a disaggregated basis (by

portfolio segment and class). e Company determined it has one

portfolio segment and one class of mortgage loans because all loans

are subject to the same monitoring and risk assessment process, and

are made exclusively to commercial borrowers. Financing receivables

other than mortgage loans are immaterial. See Note 12 (B) for

additional information.

Variable interest entities

Eff ective January 1, 2010, the Company adopted the FASB’s

amended guidance that requires ongoing qualitative analysis to

determine whether a variable interest entity must be consolidated

based on the entity’s purpose and design, the Company’s ability