Cigna 2010 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

FS-10

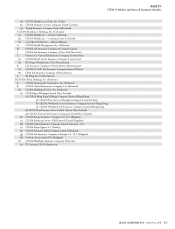

PARTIV

ITEM 15 Exhibits and Financial Statement Schedules

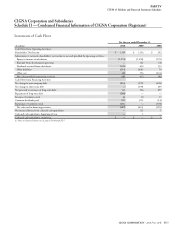

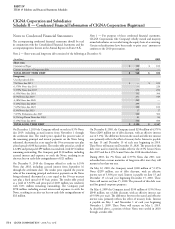

CIGNA Corporation and Subsidiaries

Schedule IV — Reinsurance

(In millions)

Gross amount Ceded to other

companies Assumed from

other companies Net amount

Percentage of

amount assumed

to net

Year Ended December 31, 2010:

Life insurance in force $ 566,841 $ 44,335 $ 9,734 $ 532,240 1.8%

Premiums and fees:

Life insurance and annuities $ 2,026 $ 264 $ 107 $ 1,869 5.7%

Accident and health insurance 16,272 173 425 16,524 2.6%

TOTAL $ 18,298 $ 437 $ 532 $ 18,393 2.9%

Year Ended December 31, 2009:

Life insurance in force $ 544,687 $ 50,011 $ 71,107 $ 565,783 12.6%

Premiums and fees:

Life insurance and annuities $ 1,909 $ 297 $ 305 $ 1,917 15.9%

Accident and health insurance 13,476 156 804 14,124 5.7%

TOTAL $ 15,385 $ 453 $ 1,109 $ 16,041 6.9%

Year Ended December 31, 2008:

Life insurance in force $ 392,803 $ 44,116 $ 108,106 $ 456,793 23.7%

Premiums and fees:

Life insurance and annuities $ 1,885 $ 281 $ 333 $ 1,937 17.2%

Accident and health insurance 13,605 230 941 14,316 6.6%

TOTAL $ 15,490 $ 511 $ 1,274 $ 16,253 7.8%

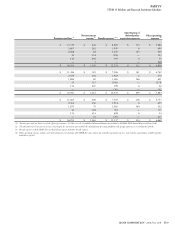

CIGNA Corporation and Subsidiaries

Schedule V — Valuation and Qualifying Accounts and Reserves

Description

(In millions)

Balance

at beginning

of period

Charged

(Credited) to costs

and expenses

(1)

Charged (Credited)

to other accounts

Other

deductions —

describe

(2)

Balance at end

ofperiod

2010:

Investment asset valuation reserves:

Commercial mortgage loans $ 17 $ 24 $ — $ (29) $ 12

Allowance for doubtful accounts:

Premiums, accounts and notes receivable $ 43 $ 11 $ — $ (5) $ 49

Deferred tax asset valuation allowance $ 116 $ (93) $ — $ — $ 23

Reinsurance recoverables $ 15 $ (5) $ — $ — $ 10

2009:

Investment asset valuation reserves:

Commercial mortgage loans $ 3 $ 17 $ — $ (3) $ 17

Allowance for doubtful accounts:

Premiums, accounts and notes receivable $ 50 $ (2) $ — $ (5) $ 43

Deferred tax asset valuation allowance $ 126 $ (2) $ — $ (8) $ 116

Reinsurance recoverables $ 23 $ (7) $ — $ (1) $ 15

2008:

Investment asset valuation reserves:

Commercial mortgage loans $1$2$—$—$3

Allowance for doubtful accounts:

Premiums, accounts and notes receivable $ 54 $ 12$1$(17) $ 50

Deferred tax asset valuation allowance $ 150 $ (15) $ — $ (9) $ 126

Reinsurance recoverables $ 27 $ (3) $ — $ (1) $ 23

(1) 2010 amount for deferred tax asset valuation allowance primarily reflects the resolution of a federal tax matter. See Note 20 to the Consolidated Financial Statements.

(2) 2010 amount for commercial mortgage loans primarily reflects charge-offs upon sales and repayments, as well as transfers to foreclosed real estate.