Cigna 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 103

PART II

ITEM 8 Financial Statements and Supplementary Data

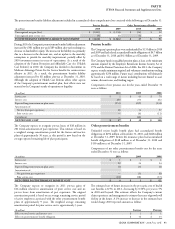

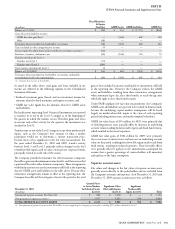

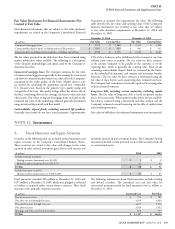

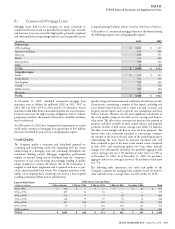

Fair Value Disclosures for Financial Instruments Not

Carried at Fair Value

Most fi nancial instruments that are subject to fair value disclosure

requirements are carried in the Company’s Consolidated Financial

Statements at amounts that approximate fair value. e following

table provides the fair values and carrying values of the Company’s

fi nancial instruments not recorded at fair value that are subject

to fair value disclosure requirements at December 31, 2010 and

December 31, 2009.

(In millions)

December31,2010 December31,2009

Fair Value Carrying Value Fair Value Carrying Value

Commercial mortgage loans $ 3,470 $ 3,486 $ 3,323 $ 3,522

Contractholder deposit funds, excluding universal life products $ 1,001 $ 989 $ 940 $ 941

Long-term debt, including current maturities, excluding capital leases $ 2,926 $ 2,709 $ 2,418 $ 2,427

e fair values presented in the table above have been estimated using

market information when available. e following is a description

of the valuation methodologies and inputs used by the Company to

determine fair value.

Commercial mortgage loans. e Company estimates the fair value

of commercial mortgage loans generally by discounting the contractual

cash fl ows at estimated market interest rates that refl ect the Company’s

assessment of the credit quality of the loans. Market interest rates

are derived by calculating the appropriate spread over comparable

U.S. Treasury rates, based on the property type, quality rating and

average life of the loan. e quality ratings refl ect the relative risk of

the loan, considering debt service coverage, the loan-to-value ratio and

other factors. Fair values of impaired mortgage loans are based on the

estimated fair value of the underlying collateral generally determined

using an internal discounted cash fl ow model.

Contractholder deposit funds, excluding universal life products.

Generally, these funds do not have stated maturities. Approximately

45% of these balances can be withdrawn by the customer at any time

without prior notice or penalty. e fair value for these contracts

is the amount estimated to be payable to the customer as of the

reporting date, which is generally the carrying value. Most of the

remaining contractholder deposit funds are reinsured by the buyers

of the individual life insurance and annuity and retirement benefi ts

businesses. e fair value for these contracts is determined using the

fair value of these buyers’ assets supporting these reinsured contracts.

e Company had a reinsurance recoverable equal to the carrying value

of these reinsured contracts.

Long-term debt, including current maturities, excluding capital

leases. e fair value of long-term debt is based on quoted market

prices for recent trades. When quoted market prices are not available,

fair value is estimated using a discounted cash fl ow analysis and the

Company’s estimated current borrowing rate for debt of similar terms

and remaining maturities.

Fair values of off -balance sheet fi nancial instruments were not material.

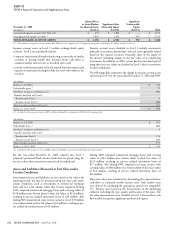

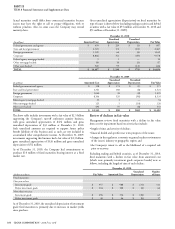

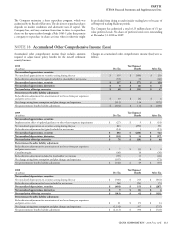

NOTE 12 Investments

A. Fixed Maturities and Equity Securities

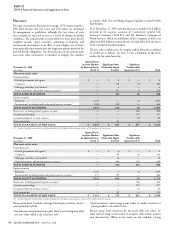

Securities in the following table are included in fi xed maturities and

equity securities on the Company’s Consolidated Balance Sheets.

ese securities are carried at fair value with changes in fair value

reported in other realized investment gains (losses) and interest and

dividends reported in net investment income. e Company’s hybrid

investments include certain preferred stock or debt securities with call

or conversion features.

(In millions)

2010 2009

Included in fi xed maturities:

Trading securities (amortized cost: $3; $8) $ 3 $ 8

Hybrid securities (amortized cost: $45; $37) 52 43

TOTAL $55 $51

Included in equity securities:

Hybrid securities (amortized cost: $108; $109) $ 86 $ 81

Fixed maturities included $98 million at December 31, 2010 and

$197 million at December 31, 2009, which were pledged as collateral

to brokers as required under certain futures contracts. ese fi xed

maturities were primarily corporate securities.

e following information about fi xed maturities excludes trading

and hybrid securities. e amortized cost and fair value by

contractual maturity periods for fi xed maturities were as follows at

December 31, 2010:

(In millions)

Amortized Cost Fair Value

Due in one year or less $ 776 $ 789

Due after one year through fi ve years 4,509 4,804

Due after fi ve years through ten years 4,835 5,256

Due after ten years 2,619 3,052

Mortgage and other asset-backed securities 658 753

TOTAL $ 13,397 $ 14,654