Cigna 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

28

PARTI

ITEM 1A Risk Factors

competitive position of insurance companies and health benefi ts

companies. Ratings information by nationally recognized ratings

agencies is broadly disseminated and generally used throughout the

industry. CIGNA believes the claims paying ability and fi nancial

strength ratings of its principal insurance subsidiaries are an important

factor in marketing its products to certain of CIGNA’s customers. In

addition, CIGNA Corporation’s debt ratings impact both the cost and

availability of future borrowings, and accordingly, its cost of capital.

Each of the rating agencies reviews CIGNA’s ratings periodically and

there can be no assurance that current ratings will be maintained in the

future. In addition, a downgrade of these ratings could make it more

diffi cult to raise capital and to support business growth at CIGNA’s

insurance subsidiaries.

Insurance ratings represent the opinions of the rating agencies on the

fi nancial strength of a company and its capacity to meet the obligations

of insurance policies. e principal agencies that rate CIGNA’s insurance

subsidiaries characterize their insurance rating scales as follows:

•A.M. Best Company, Inc. (“A.M. Best”), A++ to S (“Superior” to

“Suspended”);

•Moody’s Investors Service (“Moody’s”), Aaa to C (“Exceptional” to

“Lowest”);

•Standard & Poor’s Corp. (“S&P”), AAA to R (“Extremely Strong”

to “Regulatory Action”); and

•Fitch, Inc. (“Fitch”), AAA to D (“Exceptionally Strong” to “Order

of Liquidation”).

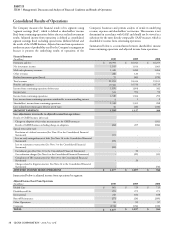

As of February 25, 2011, the insurance fi nancial strength ratings for

CIGNA subsidiaries, CGLIC and Life Insurance Company of North

America (“LINA”) were as follows:

CGLIC

Insurance Ratings

(1)

LINA

Insurance Ratings

(1)

A.M. Best A

(“Excellent”, 3rd of 16) A

(“Excellent”, 3rd of 16)

Moody’s A2

(“Good”, 6th of 21) A2

(“Good”, 6th of 21)

S&P A

(“Strong”, 6th of 21) (Not Rated)

Fitch A

(“Strong”, 6th of 24) A

(“Strong”, 6th of 24)

(1) Includes the rating assigned, the agency’s characterization of the rating and the position of the rating in the agency’s rating scale (e.g., CGLIC’s rating by A.M. Best is the 3rd highest

rating awarded in its scale of 16).

Global market, economic and geopolitical conditions

may cause fl uctuations in equity market prices, interest

rates and credit spreads which could impact the

Company’s ability to raise or deploy capital as well as

aff ect the Company’s overall liquidity.

If the capital markets and credit market experience extreme volatility

and disruption, there could be downward pressure on stock prices

and credit capacity for certain issuers without regard to those issuers’

underlying fi nancial strength. Extreme disruption in the credit

markets could adversely impact the Company’s availability and cost

of credit in the future. In addition, unpredictable or unstable market

conditions could result in reduced opportunities to fi nd suitable

opportunities to raise capital.

Operational and Other Risks

CIGNA’s business depends on the uninterrupted

operation of its systems and business functions, including

information technology and other business systems.

CIGNA’s business is highly dependent upon its ability to perform, in

an effi cient and uninterrupted fashion, its necessary business functions,

such as: claims processing and payment; internet support and customer

call centers; and the processing of new and renewal business. A power

outage, pandemic, or failure of one or more of information technology,

telecommunications or other systems could cause slower system

response times resulting in claims not being processed as quickly as

clients desire, decreased levels of client service and client satisfaction,

and harm to CIGNA’s reputation. In addition, because CIGNA’s

information technology and telecommunications systems interface with

and depend on third-party systems, CIGNA could experience service

denials if demand for such service exceeds capacity or a third-party

system fails or experiences an interruption. If sustained or repeated, such

a business interruption, systems failure or service denial could result in

a deterioration of CIGNA’s ability to pay claims in a timely manner,

provide customer service, write and process new and renewal business,

or perform other necessary corporate functions. is could result in a

materially adverse eff ect on CIGNA’s business results and liquidity.

A security breach of CIGNA’s computer systems could also interrupt or

damage CIGNA’s operations or harm CIGNA’s reputation. In addition,

CIGNA could be subject to liability if sensitive customer information is

misappropriated from CIGNA’s computer systems. ese systems may be

vulnerable to physical break-ins, computer viruses, programming errors,

attacks by third parties or similar disruptive problems. Any publicized

compromise of security could result in a loss of customers or a reduction

in the growth of customers, increased operating expenses, fi nancial losses,

additional litigation or other claims, which could have a material adverse

eff ect on CIGNA’s business.

CIGNA is focused on further developing its business continuity

program to address the continuation of core business operations.

While CIGNA continues to test and assess its business continuity

program to satisfy the needs of CIGNA’s core business operations

and addresses multiple business interruption events, there is no

assurance that core business operations could be performed upon the

occurrence of such an event.