Cigna 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 105

PART II

ITEM 8 Financial Statements and Supplementary Data

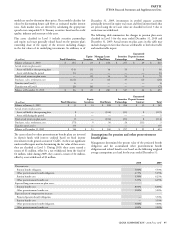

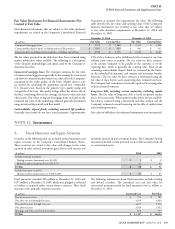

B. Commercial Mortgage Loans

Mortgage loans held by the Company are made exclusively to

commercial borrowers and are diversifi ed by property type, location

and borrower. Loans are secured by high quality, primarily completed

and substantially leased operating properties and are generally carried

at unpaid principal balances and are issued at a fi xed rate of interest.

At December 31, commercial mortgage loans were distributed among

the following property types and geographic regions:

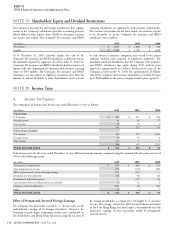

(In millions)

2010 2009

Property type

Offi ce buildings $ 1,043 $ 1,101

Apartment buildings 835 901

Industrial 619 551

Hotels 533 499

Retail facilities 418 426

Other 38 44

TOTAL $ 3,486 $ 3,522

Geographic region

Pacifi c $ 931 $ 965

South Atlantic 752 735

New England 585 566

Central 519 518

Middle Atlantic 385 408

Mountain 314 330

TOTAL $ 3,486 $ 3,522

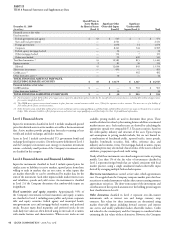

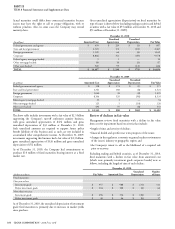

At December 31, 2010, scheduled commercial mortgage loan

maturities were as follows (in millions): $518 in 2011, $547 in

2012, $612 in 2013, $274 in 2014 and $1,535 thereafter. Actual

maturities could diff er from contractual maturities for several reasons:

borrowers may have the right to prepay obligations, with or without

prepayment penalties: the maturity date may be extended; and loans

may be refi nanced.

As of December 31, 2010, the Company had commitments to extend

credit under commercial mortgage loan agreements of $63 million

that were diversifi ed by property type and geographic region.

Credit Quality

e Company applies a consistent and disciplined approach to

evaluating and monitoring credit risk, beginning with the initial

underwriting of a mortgage loan and continuing throughout the

investment holding period. Mortgage origination professionals

employ an internal rating system developed from the Company’s

experience in real estate investing and mortgage lending. A quality

rating, designed to evaluate the relative risk of the transaction, is

assigned at each loan’s origination and is updated each year as part

of the annual portfolio loan review. e Company monitors credit

quality on an ongoing basis, classifying each loan as a loan in good

standing, potential problem loan or problem loan.

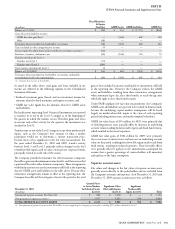

Quality ratings are based on internal evaluations of each loan’s specifi c

characteristics considering a number of key inputs, including real

estate market-related factors such as rental rates and vacancies, and

property-specifi c inputs such as growth rate assumptions and lease

rollover statistics. However, the two most signifi cant contributors to

the credit quality rating are the debt service coverage and loan-to-

value ratios. e debt service coverage ratio measures the amount of

property cash fl ow available to meet annual interest and principal

payments on debt. A debt service coverage ratio below 1.0 indicates

that there is not enough cash fl ow to cover the loan payments. e

loan-to-value ratio, commonly expressed as a percentage, compares

the amount of the loan to the fair value of the underlying property

collateralizing the loan. Based on property valuations and cash

fl ows estimated as part of the most recent annual review completed

in July, 2010, and considering updates for loans where material

changes were subsequently identifi ed, the portfolio’s aggregate debt

service coverage ratio was 1.38 and loan-to-value ratio was 74% as

of December 31, 2010. As of December 31, 2009, the portfolio’s

aggregate debt service coverage ratio was 1.48 and loan-to-value ratio

was 77%.

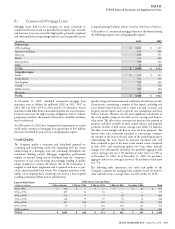

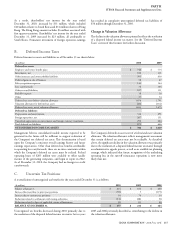

e following table summarizes the credit risk profi le of the

Company’s commercial mortgage loan portfolio based on loan-to-

value and debt service coverage ratios, as of December 31, 2010:

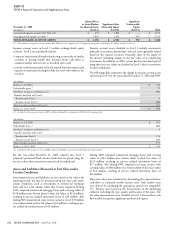

Loan-to-Value Ratios

(Dollars in millions)

Debt Service Coverage Ratio

Total1.30x or Greater 1.20x to 1.29x 1.10x to 1.19x 1.00x to 1.09x Less than 1.00x

Below 50% $ 324 $ — $ — $ — $ 29 $ 353

50% to 59% 409 54 56 — — 519

60% to 69% 533 73 5 28 25 664

70% to 79% 138 79 57 55 11 340

80% to 89% 267 186 165 151 69 838

90% to 99% 15 54 181 185 135 570

100% or above — — 47 43 112 202

TOTAL $ 1,686 $ 446 $ 511 $ 462 $ 381 $ 3,486