Cigna 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K 47

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Balance Sheet Caption/Nature of Critical

Accounting Estimate Assumptions/Approach Used E ect if Di erent Assumptions Used

Investments — Commercial Mortgage Loans —

Valuation Reserves

Recognition of losses from valuation reserves for

impaired commercial mortgage loans

To determine whether a commercial mortgage

loan is impaired, the Company evaluates the

likelihood of collecting all interest and principal

payments in accordance with the contractual

terms of the original loan agreement. When it

is probable that the Company will not collect

amounts due according to the terms of the

original loan agreement, a loan is considered

impaired and the Company must estimate the fair

value of the underlying property to measure an

impairment loss. An impairment loss is recorded

using a valuation allowance for an impaired

commercial mortgage loan’s carrying value in

excess of the estimated fair value of its underlying

property. Changes to valuation reserves are

recorded in Realized investment gains (losses).

See Note 2 (C) to the Consolidated Financial

Statements for additional information regarding

the Company’s accounting policies for

commercial mortgage loans.

e Company’s evaluation of the likelihood

of collecting all contractual payments and the

collateral fair value for commercial mortgage

loans is a qualitative and quantitative process

which is subject to uncertainties. e Company

carefully evaluates all facts and circumstances for

each loan and its supporting collateral.

When evaluating the likelihood of collecting the

contractual payments of a commercial mortgage

loan, the Company considers factors including:

• fi nancial statements, budgets and operating

plans for the property;

• inspection reports of the property completed

by third party servicers;

• debt service coverage and loan-to-value ratio

of the underlying collateral;

• the borrower’s continuing fi nancial

commitment to the property; and

• conditions and factors pertinent to the

property and its local market.

When it becomes probable that all contractual

payments will not be collected according to

the terms of the original loan agreement, the

Company calculates the estimated fair value

of the underlying property based on a 10-year

discounted cash fl ow analysis. Factors key to this

valuation include the following:

• net operating income of the property;

• rental and growth rates for the property and

its local market;

• capital requirements for the property; and

• current market discount and capitalization

rates.

ese evaluations are based primarily on an in-

depth review of the commercial mortgage loan

portfolio which is completed annually in the third

quarter. e Company updates this annual review

as material changes in these factors are identifi ed.

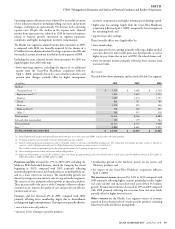

e Company recognized impairment losses from

commercial mortgage loan valuation reserves as

follows (in millions, after-tax):

•2010— $15

•2009 — $11

•2008 — $0

See the Investment Assets section of the MD&A

beginning on page 65 for discussion of the

Company’s problem and potential problem

mortgage loans and Note 12 to the Consolidated

Financial Statements for further information

surrounding impaired commercial mortgage

loans.

If loans with carrying values in excess of the fair

value of their underlying property were considered

impaired as of December 31, 2010, shareholders’

net income would decrease by approximately

$11 million after-tax.

If property values declined by 10% across

the commercial mortgage loan portfolio as of

December 31, 2010, approximately 18% of the

portfolio’s loans would have carrying values in

excess of their underlying properties’ fair values

totaling approximately $80 million. And if each

of these loans were considered impaired as of

December 31, 2010, shareholders’ net income

would decrease by approximately $52 million

after-tax.

If underlying property values declined by 10%

for impaired commercial mortgage loans with

valuation reserves as of December 31, 2010,

shareholders’ net income would decrease by

approximately $2 million after-tax.