Cigna 2010 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2010 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIGNA CORPORATION 2010 Form 10K

130

PARTIII

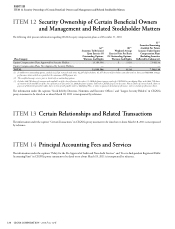

ITEM 12 Security Ownership of Certain Benefi cial Owners and Management and Related Stockholder Matters

ITEM 12 Security Ownership of Certain Benefi cial Owners

and Management and Related Stockholder Matters

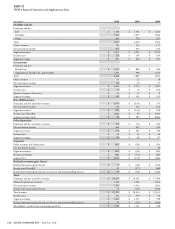

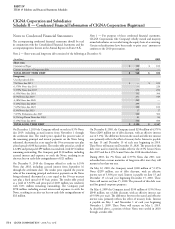

e following table presents information regarding CIGNA’s equity compensation plans as of December 31, 2010:

PlanCategory

(a)

(1)

SecuritiesToBeIssued

UponExerciseOf

OutstandingOptions,

WarrantsAndRights

(b)

(2)

WeightedAverage

ExercisePricePer Share

Of OutstandingOptions,

WarrantsAndRights

(c)

(3)

Securities Remaining

AvailableForFuture

IssuanceUnderEquity

CompensationPlans

(ExcludingSecurities

Re ectedInColumn(a))

Equity Compensation Plans Approved by Security Holders 13,189,506 $ 31.10 7,548,136

Equity Compensation Plans Not Approved by Security Holders — — —

TOTAL 13,189,506 $ 31.10 7,548,136

(1) In addition to outstanding options, includes 112,524 restricted stock units, 82,297 deferred shares, 41,457 director deferred share units that settle in shares, and 860,004 strategic

performance shares which are reported at the maximum 200% payout rate.

(2) The weighted-average exercise price is based only on outstanding options.

(3) Includes 448,790 shares of common stock available as of the close of business December 31, 2010 for future issuance under the CIGNA Directors Equity Plan; and 2,644,719 shares

of common stock available as of the close of business on December 31, 2010 for future issuance under the CIGNA Long-Term Incentive Plan as shares of restricted stock, shares in

payment of dividend equivalent rights, shares in lieu of cash payable under a Qualifying Plan, or shares in payment of strategic performance units or strategic performance shares.

e information under the captions “Stock held by Directors, Nominees and Executive Offi cers” and “Largest Security Holders” in CIGNA’s

proxy statement to be dated on or about March 18, 2011 is incorporated by reference.

ITEM 13 Certain Relationships and Related Transactions

e information under the caption “Certain Transactions” in CIGNA’s proxy statement to be dated on or about March 18, 2011 is incorporated

by reference.

ITEM 14 Principal Accounting Fees and Services

e information under the captions “Policy for the Pre-Approval of Audit and Non-Audit Services” and “Fees to Independent Registered Public

Accounting Firm” in CIGNA’s proxy statement to be dated on or about March 18, 2011 is incorporated by reference.